Part A Walmart Stores (Walmart) is the world's largest retailer. It employs an ''everyday low price'' strategy

Question:

Walmart Stores (Walmart) is the world's largest retailer. It employs an ''everyday low price'' strategy and operates stores as three business segments: Walmart Stores U.S., International, and Sam's Club.

1. Walmart Stores U.S.: This segment represented 62.3% of all 2015 sales and operates stores in three different formats: Discount stores (104,000 average square feet), Supercenters (178,000 average square feet), and Neighborhood Markets (42,000 average square feet). Each format carries a variety of clothing, housewares, electronic equipment, pharmaceuticals, health and beauty products, sporting goods, and similar items, and Supercenters include a full-line supermarket.28 Walmart U.S. stores are in all 50 states; Washington, D.C.; and Puerto Rico. Discount stores are in 41 states, Supercenters are in 49 states, and Neighborhood Markets are in 31 states. Customers also can purchase many items through the company's website at www.walmart.com.

2. International: The International segment includes wholly owned subsidiaries in Argentina, Brazil, Canada, Chile, China, India, Japan, and the United Kingdom; majority-owned subsidiaries are in Africa, Central America, and Mexico. The merchandising strategy for the International segment is similar to that of the Walmart U.S. segment.

3. Sam's Clubs: Sam's Clubs are membership club warehouses that operate in 48 states. The average Sam's Club is approximately 134,000 square feet, and customers can purchase many items through the company's website at www.samsclub.com. These warehouses offer bulk displays of brand name merchandise, including hard goods, some soft goods, institutional-size grocery items, and certain private-label items. Gross margins for Sam's Clubs stores are lower than those of the U.S. and International segments.

Walmart uses centralized purchasing through its home office for substantially all of its merchandise. It distributes products to its stores through regional distribution centers. During fiscal 2015, the proportion of merchandise channeled through its regional distribution centers was as follows:

Walmart Discount Stores, Supercenters, and Neighborhood Markets .................... 79%

Sam€™s Club (nonfuel) ....................................................................................................... 69%

International .................................................................................................................... 77%

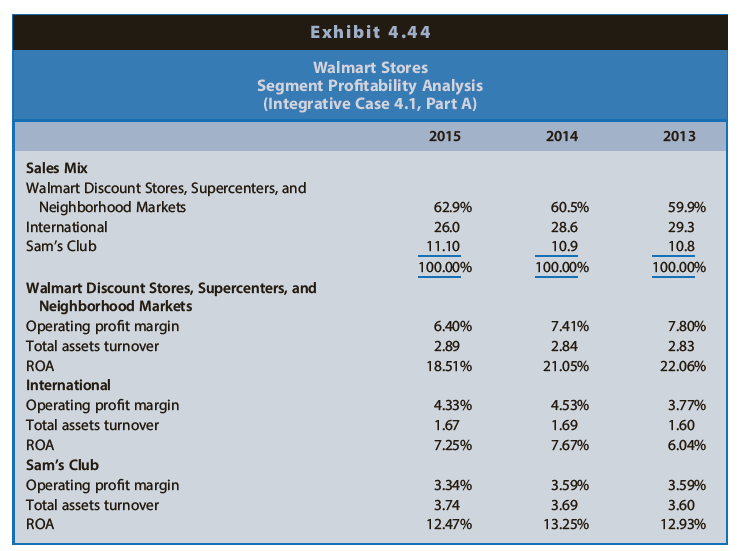

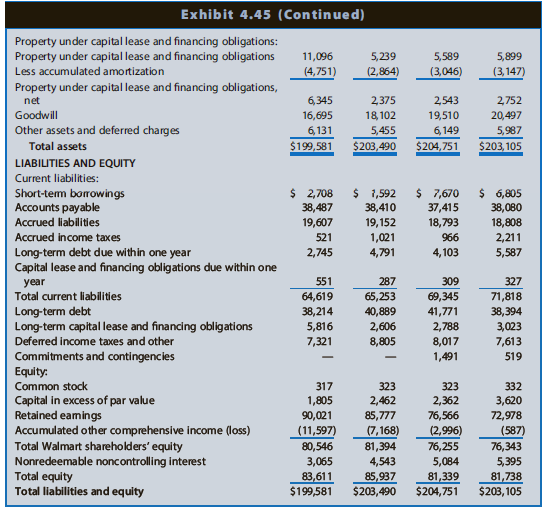

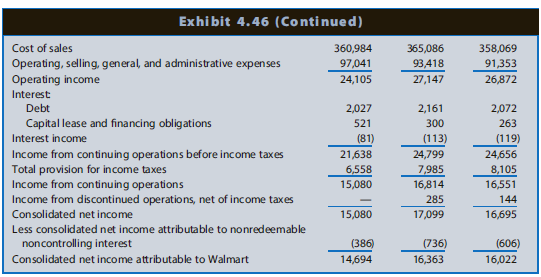

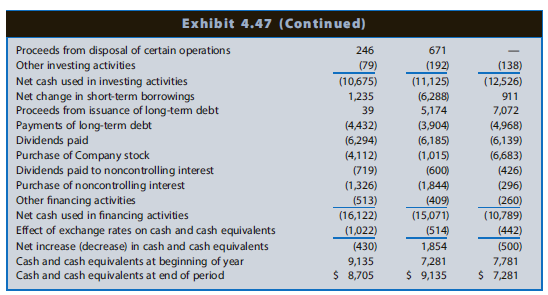

Exhibit 4.43 sets out various operating data for Walmart for 2013 through 2015. Exhibit 4.44 presents segment data. Exhibit 4.45 presents comparative balance sheets for Walmart for 2012 through 2015 (an extra year to enable average balance computations when necessary), Exhibit 4.46 presents comparative income statements for 2013 through 2015, and Exhibit 4.47 presents comparative statements of cash flows for 2013 through 2015. Exhibit 4.48 presents selected financial statement ratios for Walmart for 2013 through 2015. The statutory income tax rate is 35%.

REQUIRED

a. What are the likely reasons for the changes in Walmart's rate of ROA during the three year period? Analyze the financial ratios to the maximum depth possible.

b. What are the likely reasons for the changes in Walmart's rate of ROCE during the three year period? Note: Requirements c and d require coverage of material from Chapter 5.

c. How has the short-term liquidity risk of Walmart changed during the three-year period?

d. How has the long-term solvency risk of Walmart changed during the three-year period?

Part B

Part A of Integrative Case 4.1 analyzed the profitability and risk of Walmart Stores for its fiscal years 2013, 2014, and 2015. Part B of this case compares the profitability and risk ratios of Walmart and two other leading discount retailers, Carrefour and Target, for their 2013 through 2015 fiscal years.

Carrefour Carrefour, headquartered in France, is Europe's largest retailer and the second largest retailer in the world. Carrefour is organized by geographic region (France, Europe excluding France, Asia, and Latin America). Each segment is organized according to store formats, which include the following (2015 number of stores in parentheses):

- Hypermarkets (1,481): Offer a wide variety of household and food products at competitively low prices under the Carrefour store brand.

- Supermarkets (3,462): Sell traditional grocery products under the Market, Bairro, and Supeco store brands.

- Convenience Stores (7,181): Offer a limited variety of food products in smaller stores than those of hypermarkets and supermarkets at aggressively low prices under Express, City, Contact, Bio, Montagne, and other store brands.

- Cash & Carry (172): Provides professional restaurant and shop owners food and nonfood products at wholesale prices, under the Promocash and other store brands.

Carrefour derived approximately 47% of its 2015 sales in France, 25% in Europe excluding France, 19% in Latin America, and 9% in Asia.

Target

Target Corporation, headquartered in the United States, is a retailer that includes large-format general merchandise and food discount stores as well as an online business at www.target.com. Target stores offer a wide variety of clothing, household, electronics, sports, toy, and entertainment products at discount prices. Target stores attempt to differentiate themselves from Walmart's discount stores by pushing trendy merchandising with more brand-name products. Target emphasizes customer service, referring to its customers as ''guests'' and focusing on the theme of ''Expect More, Pay Less.'' Target Corporation attempts to differentiate itself from competitors by providing wider aisles and a less cluttered store appearance. Target discontinued its Canadian operations in 2014, which led to a significant nonrecurring loss in that year.

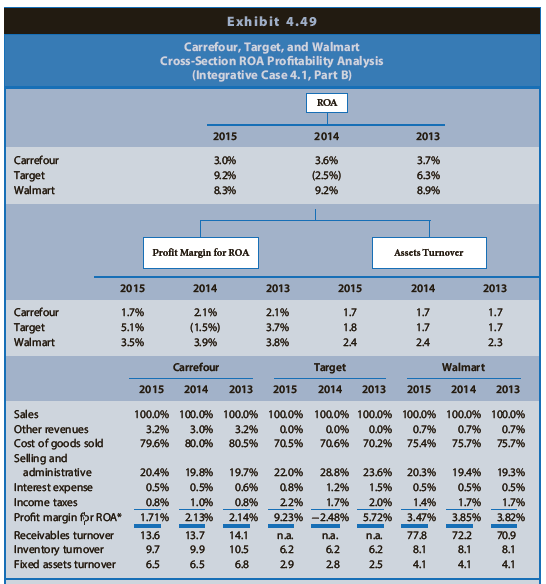

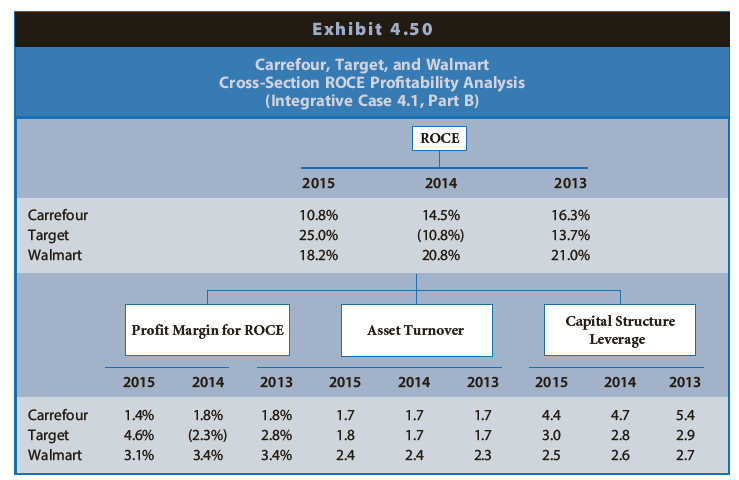

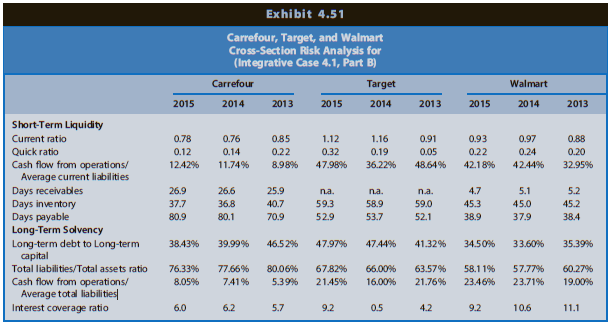

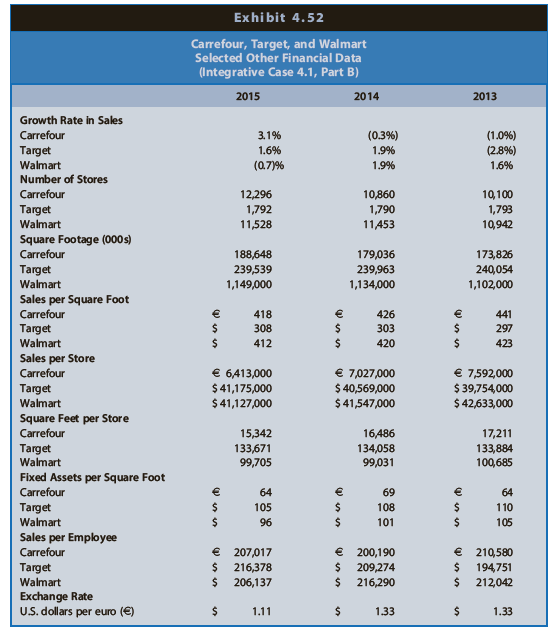

Exhibits 4.49 and 4.50 present profitability ratios for Carrefour, Target, and Walmart for their 2013 through 2015 fiscal years. Exhibit 4.51 presents risk ratios for the three firms. Exhibit 4.52 presents selected other data for these firms. The financial statements include the present value of commitments under all leases in property, plant, and equipment and in long-term debt.

REQUIRED

a. Walmart and Target follow somewhat different strategies. Using information in Exhibits 4.49 and 4.52, suggest reasons for these differences in operating profitability.

b. Walmart and Carrefour follow similar strategies, but Walmart consistently outperforms Carrefour on ROA. Using information in Exhibits 4.49 and 4.52, suggest reasons for these differences in operating profitability.

c. Refer to Exhibit 4.50. Which firm appears to have used financial leverage most effectively in enhancing the rate of ROCE? Explain your reasoning.

d. Refer to Exhibit 4.51. Rank-order these firms in terms of their short-term liquidity risk. Do any of these firms appear unduly risky as of the end of fiscal 2015? Explain.

e. Refer to Exhibit 4.51. Rank-order these firms in terms of their long-term liquidity risk. Do any of these firms appear unduly risky as of the end of fiscal 2015? Explain.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Solvency

Solvency means the ability of a business to fulfill its non-current financial liabilities. Often you have heard that the company X went insolvent, this means that the company X is no longer able to settle its noncurrent financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Distribution

The word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most... Financial Ratios

The term is enough to curl one's hair, conjuring up those complex problems we encountered in high school math that left many of us babbling and frustrated. But when it comes to investing, that need not be the case. In fact, there are ratios that,...

Step by Step Answer:

Financial Reporting Financial Statement Analysis And Valuation A Strategic Perspective

ISBN: 1711

9th Edition

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw