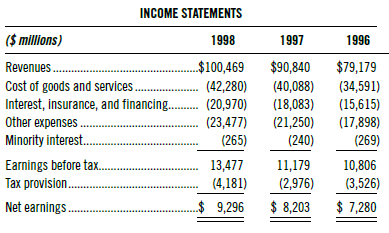

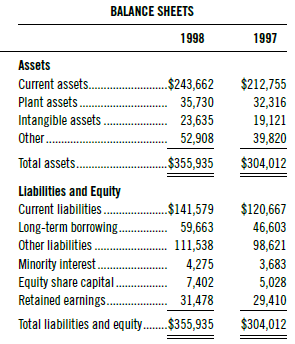

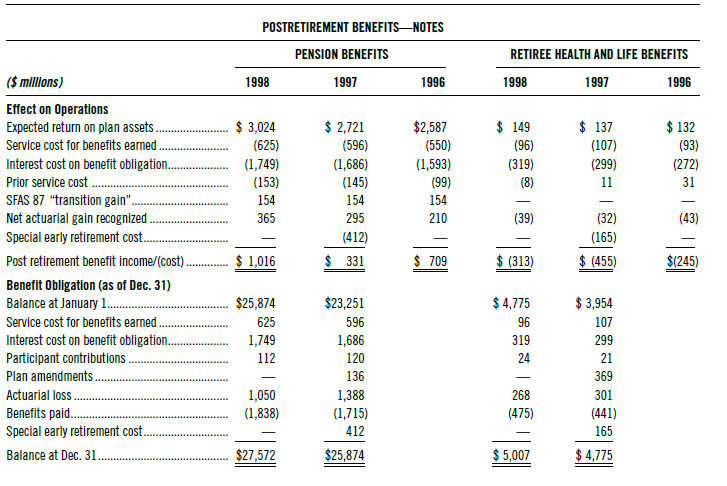

Condensed financial statements of General Electric, along with note information regarding postretirement benefits, are shown here: Note

Question:

Condensed financial statements of General Electric, along with note information regarding postretirement benefits, are shown here:

Note that this postretirement data was reported under the older standard (SFAS 87). The recognition of net position on the balance sheet under the current standard (SFAS 158) is different.

Required:

a. Determine the economic position of the postretirement plans for each of 1998 and 1997. Restate the balance sheets and examine the effect of reflecting the true position on key ratios (debt to equity, long-term debt to equity, return on equity).

b. What is economic pension cost for each of 1998 and 1997? Reconcile it with the reported pension expense. Determine the pension expense you would consider when determining GE’s permanent income and economic income.

c. Examine how the current accounting (under SFAS 158) would recognize and report the provided pension and OPEB numbers. In particular, discuss how the net economic position will be featured in the balance sheet with specific reference to how the balance sheet numbers will be articulated with that recognized in the income statement (periodic net benefit cost).

d. Evaluate the key actuarial assumptions. Is there any hint of earnings management?

e. In its editorial, Barron’s hinted GE was using pensions to manage its earnings growth: In 1997, pension income chipped in $331 million of GE’s total earnings of $8.2 billion. In 1998, pension income accounted for $1.01 billion of the company’s total earnings of $9.3 billion. Okay, let’s suppose that there was no contribution to earnings in either years (these are not, in any case, actual cash additions). Minus the noncash contributions from the pension plans, GE’s 1997 net was $7.9 billion; its 1998 net amounted to $8.3 billion. On this basis, the rise in earnings last year was roughly $400 million, or about 5.1%. And 5.1%, while respectable, is a good cut below the 13% the company triumphantly announced . . . GE’s shares, as we observed, are selling at some 40 times last year’s earnings. Do you agree with Barron’s editorial? In what manner, if any, might GE be managing its earnings through pensions?

f. Note the reference to cash flows in the Barron’s editorial—“these are not, in any case, actual cash additions.” Is it true that every earnings effect that does not necessarily have an equal and contemporaneous cash flow effect is tainted in some manner? Answer this question with respect to GE’s pension disclosures. What are the cash flows relating to GE’s postretirement plans? How useful are these cash flows for understanding the economics of postretirement benefit plans—are they more meaningful than the pension expense (income) number?

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Financial Statement Analysis

ISBN: 978-0073379432

10th edition

Authors: K. R. Subramanyam, John J. Wild