Question: The following income statement and balance sheets for Virtual Gaming Systems are provided. Required: Assuming that all sales were on account, calculate the following risk

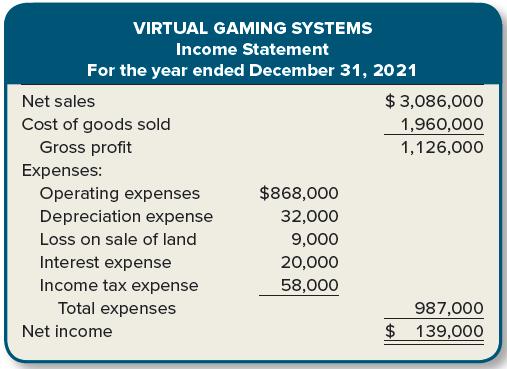

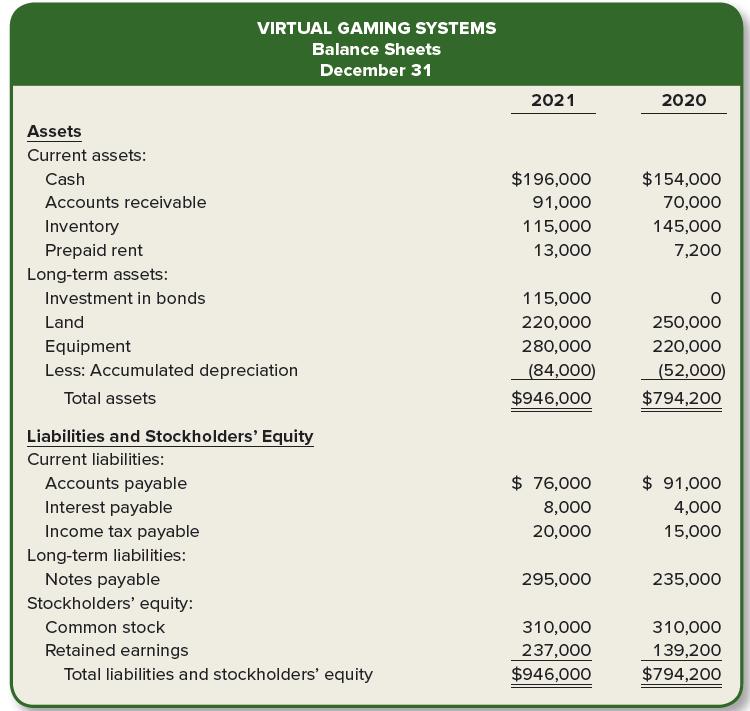

The following income statement and balance sheets for Virtual Gaming Systems are provided.

Required:

Assuming that all sales were on account, calculate the following risk ratios for 2021.

1. Receivables turnover ratio.

2. Average collection period.

3. Inventory turnover ratio.

4. Average days in inventory.

5. Current ratio.

6. Acid-test ratio.

7. Debt to equity ratio.

8. Times interest earned ratio.

VIRTUAL GAMING SYSTEMS Income Statement For the year ended December 31, 2021 Net sales $ 3,086,000 Cost of goods sold 1,960,000 Gross profit 1,126,000 Expenses: $868,000 Operating expenses Depreciation expense 32,000 Loss on sale of land 9,000 Interest expense 20,000 Income tax expense 58,000 Total expenses 987,000 Net income $ 139,000

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

A B 1 2 C D E RECEIVABLE TURNOVER RATIO F VIRTUAL GAMING SYSTEMS AVERAGE ACCOUNTS RECEIVABLE AVERAGE ... View full answer

Get step-by-step solutions from verified subject matter experts