Suppose that we wished to conduct an event study on whether acquiring firms experience share price reactions

Question:

Suppose that we wished to conduct an event study on whether acquiring firms experience share price reactions to takeover announcements. For our event study, we will use for our sample the following three acquiring firms:

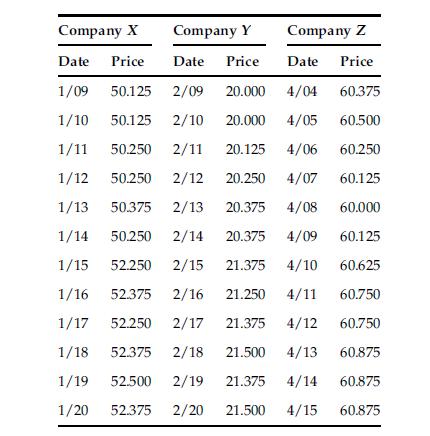

Company X: Merger announcement date January 15, 2012 Company Y: Merger announcement date February 15, 2012 Company Z: Merger announcement date April 10, 2012 Suppose we establish an 11-day testing period for returns around the event dates, the event date plus five days before and five days after. The following table provides our three acquiring firm stock prices during 12-day periods around merger announcement dates:

a. Compute one-day returns for each of 11 days for each of the three stocks.

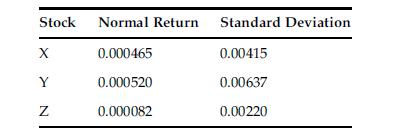

b. Suppose that we have decided to use the mean adjusted return method to compute excess or abnormal stock returns. Here, we will compute mean daily returns for each security for a period outside of our 11-day testing period. Suppose we compute average daily returns and standard deviations for each of the stocks for 180-day periods prior to the testing periods (the raw returns data are not given here). Suppose that we have found normal or expected daily returns along with standard deviations as follows:

Compute excess returns for each stock for each of the 11 days.

c. For each of the 11 days in the analysis, compute average residuals for the three stocks. Then, for each day, compute a standard deviation of residuals for the three stocks. Finally, compute normal deviates for each of the 11 dates based on the averages and standard deviations for the three stocks.

d. Are average residuals for any of the dates statistically significant at the 95% level?

e. Compute cumulative average residuals for each of the 11 dates.

f. Compute standard deviations and normal deviates for each of the 11 dates.

g. Does there appear to be statistically significant evidence of abnormal acquiring firm returns around announcement dates?

Step by Step Answer: