Question: A financial analyst compares a portfolio evenly split between two technology company bonds trading at par to an index with an average OAS of 125

A financial analyst compares a portfolio evenly split between two technology company bonds trading at par to an index with an average OAS of 125 bps.

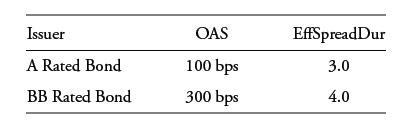

Calculate the portfolio DTS, and estimate how the technology bond portfolio will perform if index OAS widens by 10 bps.

Issuer A Rated Bond BB Rated Bond OAS 100 bps 300 bps EffSpreadDur 3.0 4.0

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Portfolio DTS is the market valueweighted average of DTS based o... View full answer

Get step-by-step solutions from verified subject matter experts