An active United Statesbased credit manager is offered similar US corporate bond portfolio choices to those in

Question:

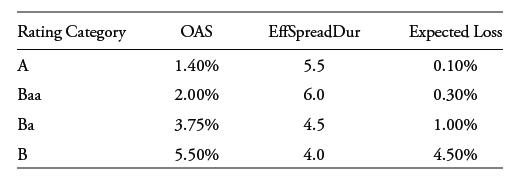

An active United States–based credit manager is offered similar US corporate bond portfolio choices to those in an earlier example:

As in the earlier case, the manager expects an economic rebound but now believes that European economies will experience a stronger recovery than the United States.

In particular, European high-yield credit spreads are expected to narrow by 25% in the near term, the euro is expected to appreciate 1% against the US dollar, and all US credit spreads are expected to decline just 10% over the same period. The euro-denominated 5-year European iTraxx Crossover index (iTraxx-Xover) of liquid high-yield issuers (with a 5% fixed premium) is currently trading at 400 bps with an EffSpreadDurCDS of 4.25.

Describe the position the manager would take in iTraxx-Xover to capitalize on the stronger European rebound, and calculate the expected excess return percentage assuming an equally weighted allocation to US corporate bonds and an iTraxx-Xover position that matches that of the US high-yield bond allocation.

Step by Step Answer: