Question: An analyst evaluates the following information relating to floating-rate notes (FRNs) issued at par value that have three-month MRR as a reference rate: Based only

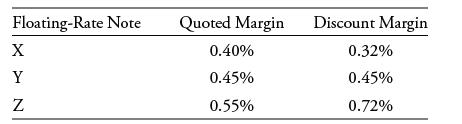

An analyst evaluates the following information relating to floating-rate notes (FRNs) issued at par value that have three-month MRR as a reference rate:

Based only on the information provided, the FRN that will be priced at a premium on the next reset date is:

A. FRN X.

B. FRN Y.

C. FRN Z.

Floating-Rate Note X Y N Quoted Margin 0.40% 0.45% 0.55% Discount Margin 0.32% 0.45% 0.72%

Step by Step Solution

3.39 Rating (155 Votes )

There are 3 Steps involved in it

To determine which FRN will be priced at a premium on the next reset date we need to compare the quo... View full answer

Get step-by-step solutions from verified subject matter experts