Assume the manager is able to extend her mandate by adding derivatives strategies to the three portfolio

Question:

Assume the manager is able to extend her mandate by adding derivatives strategies to the three portfolio alternatives. The best way to position her portfolio to benefit from a bear flattening scenario is to combine a:

A. 2-year receive-fixed Australian dollar (AUD) swap with the same money duration as the bullet portfolio.

B. 2-year pay-fixed AUD swap with twice the money duration as the 2-year government bond in the barbell portfolio.

C. 9-year receive-fixed AUD swap with twice the money duration as the 9-year government bond position in the equally weighted portfolio.

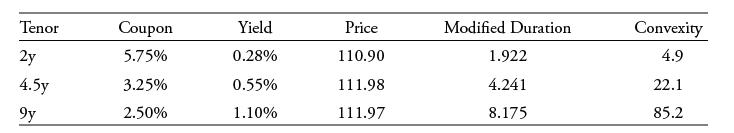

A Sydney-based fixed-income portfolio manager is considering the following Commonwealth of Australia government bonds traded on the ASX (Australian Stock Exchange):

The manager is considering portfolio strategies based upon various interest rate scenarios over the next 12 months. She is considering three long-only government bond portfolio alternatives, as follows:

Bullet: Invest solely in 4.5-year government bonds

Barbell: Invest equally in 2-year and 9-year government bonds

Equal weights: Invest equally in 2-year, 4.5-year, and 9-year bonds

Step by Step Answer: