Question: Based on the information in Exhibit 2, GZ Groups (a hypothetical company) credit risk is most likely: A. Lower than the industry. B. Higher than

Based on the information in Exhibit 2, GZ Group’s (a hypothetical company) credit risk is most likely:

A. Lower than the industry.

B. Higher than the industry.

C. The same as the industry.

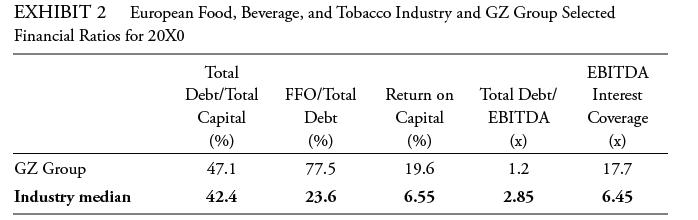

EXHIBIT 2 European Food, Beverage, and Tobacco Industry and GZ Group Selected Financial Ratios for 20X0 GZ Group Industry median Total Debt/Total Capital (%) 47.1 42.4 FFO/Total Debt (%) 77.5 23.6 Return on Capital (%) 19.6 6.55 Total Debt/ EBITDA 1.2 2.85 EBITDA Interest Coverage (x) 17.7 6.45

Step by Step Solution

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Based on the information in Exhibit 2 GZ Groups a hypothetical company credit ri... View full answer

Get step-by-step solutions from verified subject matter experts