Consider the following two bonds that pay interest annually: At a market discount rate of 4%, the

Question:

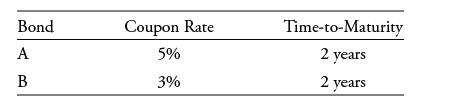

Consider the following two bonds that pay interest annually:

At a market discount rate of 4%, the price difference between Bond A and Bond B per 100 of par value is closest to:

A. 3.70.

B. 3.77.

C. 4.00.

Transcribed Image Text:

Bond A B Coupon Rate 5% 3% Time-to-Maturity 2 years 2 years

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

To calculate the price difference between Bond A and Bond B per 100 of par value at a market discoun...View the full answer

Answered By

Danish Sohail

My objective is to become most reliable expert for clients. For last 10 years I have been associated with the field of accounting and finance. My aim is to strive for best results and pay particular attention to client needs. I am always enthusiastic to help clients for issues and concerns related to business studies. I can work on analysis of the financial statements, calculate different ratios and analysis of ratios. I can critically evaluate stock prices based on the financial analysis and valuation for companies using financial statements of the business entity being valued with use of excel tools. I have expertise to provide effective and reliable help for projects in corporate finance, equity investments, financial accounting, cost accounting, financial planning, business plans, marketing plans, performance measurement, budgeting, economic research, risk assessment, risk management, derivatives, fixed income investments, taxation, auditing, and financial performance analysis.

4.80+

78+ Reviews

112+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Consider two bonds that pay holders semi annually: Coupon Rate Par Value Maturity Value/Price Bond A 4% $1000 20 years ? Bond B 3% $1000 20 years ? Part A: Calculate the value/price of each bond if...

-

A zero-coupon bond matures in 15 years. At a market discount rate of 4.5% per year and assuming annual compounding, the price of the bond per 100 of par value is closest to: A. 51.30. B. 51.67. C....

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

Ford Company's cost of capital is 13%. It has invested x (million dollars) in current assets. The following function represents the shortage cost of its current assets: S = 9 e- x/3 Find the...

-

The acquisition of equipment by assuming a mortgage is a transaction that firms cannot report in their statement of cash flows but must report in a supplemental schedule or note. Of what value is...

-

_______________ type of testing is done on each module. (a) Unit (b) Alpha (c) Integrated (d) Beta

-

How do we derive Modes and States?

-

West Yellowstone Outfitters Corporation manufactures and distributes leisure clothing. Selected transactions completed by West Yellowstone Outfitters during the current fiscal year are as follows:...

-

A straight 25 cm pipeline 5 km long is laid between two reservoirs having a difference of levels of 40 mtrs. To increase the capacity of the system, an additional 2.5 km long 2.5 cm pipe is laid...

-

A bond offers an annual coupon rate of 4%, with interest paid semiannually. The bond matures in two years. At a market discount rate of 6%, the price of this bond per 100 of par value is closest to:...

-

An investor who owns a bond with a 9% coupon rate that pays interest semiannually and matures in three years is considering its sale. If the required rate of return on the bond is 11%, the price of...

-

1) Based on the following information, calculate the risk of each asset class in relation to its annual historic return. 2) Run the same calculations except this time take into account a 2% inflation...

-

Explain briefly about soldering.

-

Enumerate and explain various allowances provided for pattern making.

-

Amigos Burrito Inc. sells franchises to independent operators throughout the northwestern part of Brazil. The contract with the franchisee includes the following provisions. 1. The franchisee is...

-

What are the advantages and disadvantages of die casting?

-

Explain the advantages and disadvantages of sand casting.

-

What is the distinction between management discretion and the intentional falsification of accounting records?

-

Explain how the graph of each function can be obtained from the graph of y = 1/x or y = 1/x 2 . Then graph f and give the (a) Domain (b) Range. Determine the largest open intervals of the domain over...

-

This problem lets you see the dynamics of break-even analysis. The starting values (costs, revenues, etc.) for this problem are from the break-even analysis example in this chapter (see Exhibit...

-

Give an example of how a firm has used information technology to improve its marketing implementation and do a better job of meeting your needs.

-

Should marketing managers leave it to the accountants to develop reports that the marketing manager will use to improve implementation and control? Why or why not?

-

Consider the LP problem max x + 2y s.t. (a) Solve it. (b) Formulate and solve the dual problem. x + y 4 -x+y1 2x - y 3 x 0, y 0

-

In this module, we've looked at three distinct methods for vetting sources (CRAAP, SIFT, and VIA). Which method do you find to be more valuable? Which do you find to be most workable? Which do you...

-

How does the level of social capital in a community correlate with its median household income and poverty rates?

Study smarter with the SolutionInn App