Keisha Jones is a junior analyst at Sparling Capital. Julie Anderson, a senior partner and Joness manager,

Question:

Keisha Jones is a junior analyst at Sparling Capital. Julie Anderson, a senior partner and Jones’s manager, meets with Jones to discuss interest rate models used for the firm’s fixed-income portfolio.

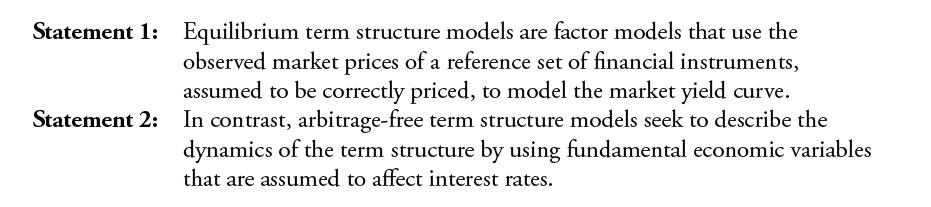

Anderson begins the meeting by asking Jones to describe features of equilibrium and arbitrage- free term structure models. Jones responds by making the following statements:

Anderson then asks Jones about her preferences concerning term structure models. Jones states:

I prefer arbitrage-free models. Even though equilibrium models require fewer parameters to be estimated relative to arbitrage-free models, arbitrage-free models allow for time-varying parameters. In general, this allowance leads to arbitrage-free models being able to model the market yield curve more precisely than equilibrium models.

Which of Jones’s statements regarding equilibrium and arbitrage-free term structure models is incorrect?

A. Statement 1 only

B. Statement 2 only

C. Both Statement 1 and Statement 2

Step by Step Answer: