Mr. Zheng is a Shanghai-based wealth adviser. A major client of his, the Wang family, holds most

Question:

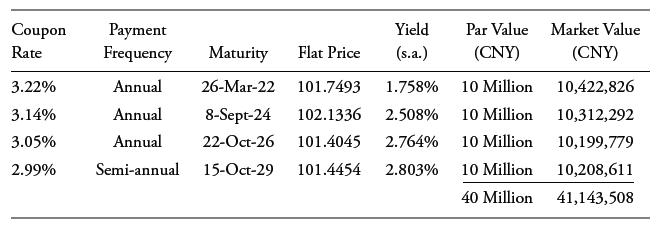

Mr. Zheng is a Shanghai-based wealth adviser. A major client of his, the Wang family, holds most of its assets in residential property and equity investments and relies on regular cash flows from those holdings. Zheng recommends that the Wang family also have a laddered portfolio of Chinese government bonds. He suggests the following portfolio, priced for settlement on 1 January 2021:

The yields to maturity on the first three bonds have been converted from a periodicity of one to two in order to report them on a consistent semi-annual bond basis, as indicated by “(s.a.).” The total market value of the portfolio is CNY 41,143,508. The cash flow yield for the portfolio is 2.661%, whereas the market value-weighted average yield is 2.455%.

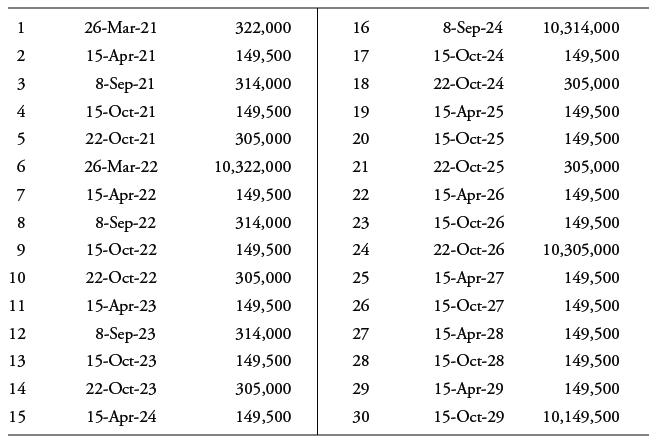

Most important for his presentation to the senior members of the Wang family is the schedule for the 30 cash flows:

Indicate the main points that Zheng should emphasize in this presentation about the laddered portfolio to senior members of the Wang family.

Step by Step Answer: