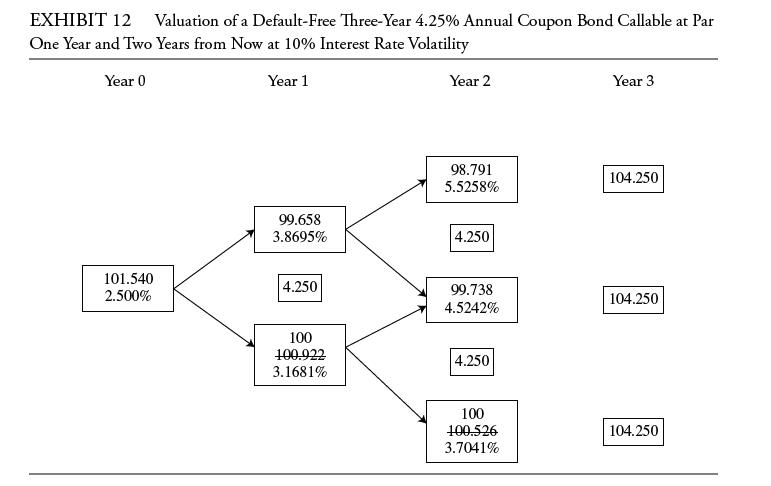

Return to the valuation of the Bermudan-style three-year 4.25% annual coupon bond callable at par one year

Question:

Return to the valuation of the Bermudan-style three-year 4.25% annual coupon bond callable at par one year and two years from now as depicted in Exhibit 12. The one-year, two-year, and three-year par yields are 2.500%, 3.000%, and 3.500%, respectively, and the interest rate volatility is 10%.

Assume that nothing changes relative to the initial setting except that the interest rate volatility is now 15% instead of 10%. The new value of the callable bond is:

A. Less than 101.540.

B. Equal to 101.540.

C. More than 101.540.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: