Robert Jourdan, a portfolio manager, has just valued a 7% annual coupon bond that was issued by

Question:

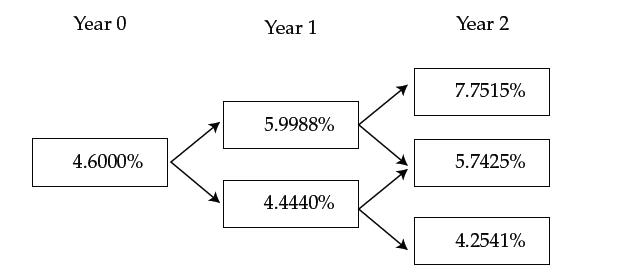

Robert Jourdan, a portfolio manager, has just valued a 7% annual coupon bond that was issued by a French company and has three years remaining until maturity. The bond is callable at par one year and two years from now. In his valuation, Jourdan used the yield curve based on the on-the-run French government bonds. The one-year, two-year, and three-year par rates are 4.600%, 4.900%, and 5.200%, respectively. Based on an estimated interest rate volatility of 15%, Jourdan constructed the following binomial interest rate tree:

Jourdan valued the callable bond at 102.294% of par. However, Jourdan’s colleague points out that because the corporate bond is riskier than French government bonds, the valuation should be performed using an OAS of 200 bps.

To update his valuation of the French corporate bond, Jourdan should:

A. Subtract 200 bps from the bond’s annual coupon rate.

B. Add 200 bps to the rates in the binomial interest rate tree.

C. Subtract 200 bps from the rates in the binomial interest rate tree.

Step by Step Answer: