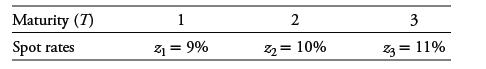

The spot rates for three hypothetical zero-coupon bonds (zeros) with maturities of one, two, and three years

Question:

The spot rates for three hypothetical zero-coupon bonds (zeros) with maturities of one, two, and three years are given in the following table. Based on your answers to 1 and 2, describe the relationship between the spot rates and the implied one-year forward rates.

Based on your answers to 1 and 2, describe the relationship between the spot rates and the implied one-year forward rates.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: