Question: Using the information in the following table, construct an Excel spreadsheet to answer questions (a)(d). Assume the frequency of both sides of the swap is

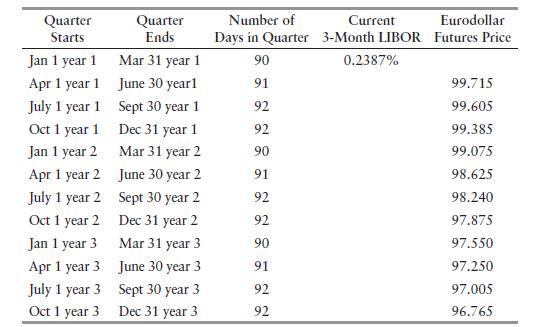

Using the information in the following table, construct an Excel spreadsheet to answer questions (a)–(d).

Assume the frequency of both sides of the swap is quarterly and both use an actual/360 day count convention.

a. What are projected future floating payments implied by the Eurodollar futures prices?

b. What are the forward discount factors?

c. What is the swap rate that will make the present value of the net cash flows equal to zero?

d. Suppose the 3-year Treasury is 1.375%, what is the swap spread?

Quarter Starts Quarter Ends Number of Days in Quarter Current 3-Month LIBOR Futures Price Eurodollar Jan 1 year 1 Mar 31 year 1 90 0.2387% Apr 1 year 1 June 30 year1 91 99.715 July 1 year 1 Sept 30 year 1 92 99.605 Oct 1 year 1 Dec 31 year 1 92 99.385 Jan 1 year 2 Mar 31 year 2 90 99.075 Apr 1 year 2 June 30 year 2 91 98.625 July 1 year 2 Sept 30 year 2 92 98.240 Oct 1 year 2 Dec 31 year 2 92 97.875 Jan 1 year 3 Mar 31 year 3 90 97.550 Apr 1 year 3 June 30 year 3 91 97.250 July 1 year 3 Sept 30 year 3 92 97.005 Oct 1 year 3 Dec 31 year 3 92 96.765

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts