Ace Trucking Company is considering buying 50 new diesel trucks that are 15 percent more fuel-efficient than

Question:

Mr. King assumes the price of diesel fuel is an external market force he cannot control, and any increased costs of fuel will be passed on to the shipper through higher rates. If this is true, then fuel efficiency would save more money as the price of diesel fuel rises (at $1.215 per litre, he would save $5,467,500 in total if he buys the new trucks).

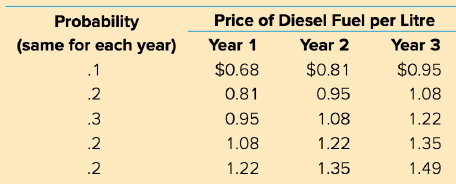

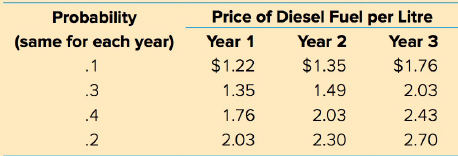

Mr. King has come up with two possible forecasts as shown below-each of which he believes has about a 50 percent chance of coming true. Under assumption one, diesel prices will stay relatively low; under assumption two, diesel prices will rise considerably.

Fifty new trucks will cost Ace Trucking $13.25 million. They will qualify for a 30 percent

CCA. The firm has a tax rate of 30 percent and a cost of capital of 11 percent.

a. First, compute the yearly expected costs of diesel fuel for both assumption one (relatively low diesel prices) and assumption two (high diesel prices) from the forecasts below.

Forecast for assumption one:

Forecast for assumption two:

b. What will be the dollar savings in diesel expenses for each year for assumption one and for assumption two?

c. Find the increased cash flow after taxes for both forecasts.

d. Compute the NPV of the truck purchases for each fuel forecast assumption and the combined net present value (that is, weigh the NPVs by .5).

e. If you were Mr. King, would you go ahead with this capital investment?

f. How sensitive to fuel prices is this capital investment?

What is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Cost Of Capital

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Foundations of Financial Management

ISBN: 978-1259024979

10th Canadian edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta

Question Posted: