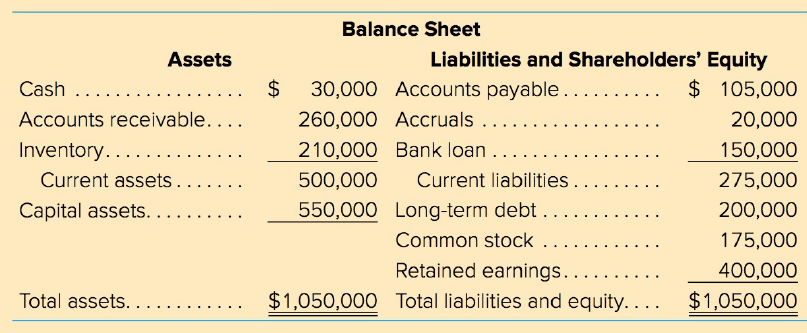

Clyde's Well Servicing has the following financial statements. The balance sheet items, profit margin, and dividend payout

Question:

Income Statement

Sales ...................................... . ..................$2,000,000

Cost of goods sold ...... ..... . .. .. .. . ....... . .....1,260,000

Gross profit. ........................ . ....... . .................740,000

Sell ing and administrative expense. ................400,000

Amortization ............................ . . .......................55,000

Earnings before interest and taxes ...... . . .........285,000

Interest .. .............................................................50,000

Earnings before taxes .......................................235,000

Taxes ...................................... . ..........................61,000

Earnings ava ilable to common shareholders. $ 174,000

Dividends paid ............................................. . $ 104,400

a. Using a percent-of-sales method, determine whether Clyde's can handle a 30 percent sales increase without using external financing. If so, what is the need?

b. If the average collection period of receivables could be held to 43 days, what would the need be for external financing? All other relationships remain the same.

c. Suppose the following results with the increased sales of $600,000.

Cash increases by ...................................................... .........$5,000

Average collection period .... .. ... . ......... .. .. ... . . ...............43 days

Inventory turnover (COGS) ... .. .. .. ......... .. .. .. .. . .............6X

Capital assets increase by .. ................................................$125,000

Accounts payable increase...................................................in proportion to sales

Accruals ........................ .. ...................................................no change

Long-term debt decreases by ..... . ......... .. .. ... . . . ............$25,000

Gross profit margin . ............................................................40%

Sell ing, general, and administrative expense increase by ..$50,000

Amortization increases by. ...................................................$12,500

Interest decreases by ........ .. .. .. ......... .. .. .. .. . . ...............$10,000

Tax rate .................. .. .. ... . ......... .. .. ... . . . ........................35%

Dividends increase to ............................................................$120,000

What new funds would be required? The first $75,000 of any new funds would be short-term debt and then long-term debt. Prepare the pro forma balance sheet.

DividendA dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Foundations of Financial Management

ISBN: 978-1259024979

10th Canadian edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta