Given the following information, calculate the weighted average cost of capital for Genex Corporation. Line up the

Question:

Percent of capital structure:

Debt.......................................................35%

Preferred stock ...... . .. .. ... ......... . .. . .10

Common equity .......................... . .......55

Additional information:

Bond coupon rate ......................... .......13%

Bond yield .......................... . . .. . .........11%

Dividend, expected common ........ . .$3.00

Dividend, preferred..........................$10.00

Price, common ......... . .. .. . ......... . $50.00.

Price, preferred ............ . . ..... . .. . .$98.00

Flotation cost, preferred .......... .. .. . .$5.50

Corporate growth rate .................. .. .. . .8%

Corporate tax rate .............. .................30%

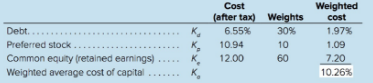

Table 11.1

A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity. Coupons are usually referred to in terms of the coupon rate (the sum of coupons paid in a...

Step by Step Answer:

Foundations of Financial Management

ISBN: 978-1259024979

10th Canadian edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta