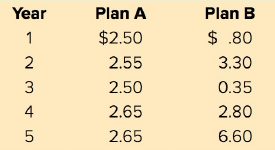

In doing a five-year analysis of future dividends, Newell Labs Inc. is considering the following two plans.

Question:

a. How much, in total dividends per share, will be paid under each plan over the five years?

b. Ms. Carter, the vice-president of finance, suggests that shareholders often prefer a stable dividend policy to a highly variable one. She will assume shareholders apply a lower discount rate to dividends that are stable. The discount rate to be used for Plan A is 10 percent; the discount rate for Plan B is 12 percent. Which plan will provide the higher present value for the future dividends?

Depending upon the context, the discount rate has two different definitions and usages. First, the discount rate refers to the interest rate charged to the commercial banks and other financial institutions for the loans they take from the Federal... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Foundations of Financial Management

ISBN: 978-1259024979

10th Canadian edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta

Question Posted: