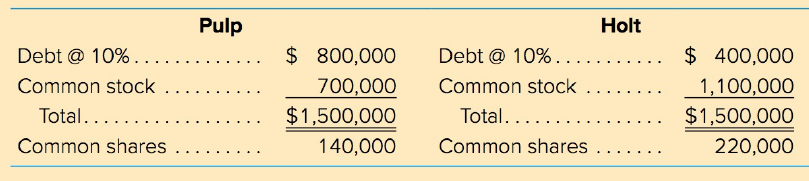

Pulp Paper Company and Holt Paper Company are each able to generate EBIT of $150,000. The separate

Question:

a. Compute EPS for both firms (assume a 40 percent tax rate).

$ 400,000

1,100,000

$1,500,000

220,000

b. Assuming a P /E ratio of 20 for each firm, what would be each firm's share price?

c. Assume the P /E ratio would be 15 for the riskier company in terms of heavy debt utilization in the capital structure and 26 for the less risky firm. What would the share price now be for each firm?

d. Based on the evidence in part c, should management be concerned about the impact of financing plans on EPS or should share price also be considered?

Capital structure refers to a company’s outstanding debt and equity. The capital structure is the particular combination of debt and equity used by a finance its overall operations and growth. Capital structure maximizes the market value of a...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Foundations of Financial Management

ISBN: 978-1259024979

10th Canadian edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta

Question Posted: