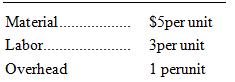

The Bradley Corporation produces a product with the following costs as of July 1, 20X1: Beginning inventory

Question:

The Bradley Corporation produces a product with the following costs as of July 1, 20X1:

Beginning inventory at these costs on July 1 was 3,700 units. From July 1 to December 1, 20X1, Bradley produced 13,400 units. These units had a material cost of $2, labor of $3, and overhead of $4per unit. Bradley uses LIFO inventory accounting. Assuming that Bradley sold 15,800 units during the last six months of the year at $14each, what is its gross profit? What is the value of ending inventory?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Foundations Of Financial Management

ISBN: 9781264097623

18th Edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen

Question Posted: