The CFO of Lazy Loungers is evaluating the following independent, indivisible projects: Lazy?s weighted average cost of

Question:

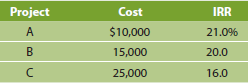

The CFO of Lazy Loungers is evaluating the following independent, indivisible projects:

Lazy?s weighted average cost of capital (WACC) is 14 percent if the firm does not have to issue new common equity; if new common equity is needed, its WACC is 17 percent. Lazy?s capital structure consists of 40 percent debt. If Lazy has no preferred stock and expects to generate $24,000 in retained earnings this year, which project(s) should be purchased?

Capital StructureCapital structure refers to a company’s outstanding debt and equity. The capital structure is the particular combination of debt and equity used by a finance its overall operations and growth. Capital structure maximizes the market value of a... Cost Of Capital

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: