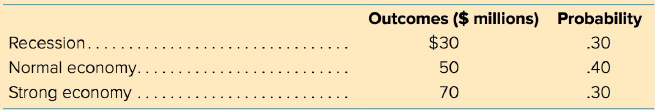

Transoceanic Airlines is examining a resort motel chain to add to its operations. Before the acquisition, the

Question:

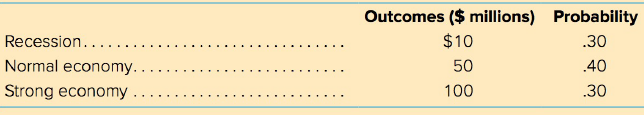

After the acquisition the expected outcomes for the firm would be

a. Compute the expected value, standard deviation, and coefficient of variation before the acquisition.

After the acquisition these values are as follows:

Expected value....................53.0 ($ millions)

Standard deviation ......... . .34.9 ($ millions)

Coefficient of variation ..... . .658

b. Comment on whether this acquisition appears desirable to you.

c. Do you think the firm's share price is likely to go up as a result of this acquisition?

d. If the firm was interested in reducing its risk exposure, which of the following three industries would you advise it to consider for an acquisition? Briefly comment on your answer.

(1) Major travel agency

(2) Oil company

(3) Gambling casino

Step by Step Answer:

Foundations of Financial Management

ISBN: 978-1259024979

10th Canadian edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta