1. What are the objectives of U.S. monetary policy? 2. What is core inflation and how does...

Question:

1. What are the objectives of U.S. monetary policy?

2. What is core inflation and how does it differ from total PCEPI inflation?

3. What is the Fed’s monetary policy instrument and what influences the level at which the Fed sets it?

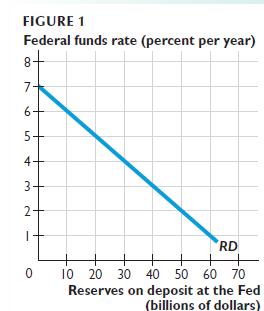

4. Figure 1 shows the demand curve for bank reserves, RD. The current quantity of reserves supplied is $20 billion. The Fed wants to set the federal funds rate at 4 percent a year. Illustrate the target on the graph and show the supply of reserves that will achieve the target. Does the Fed conduct an open market operation and if so, does it buy or sell securities?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: