ArcelorMittal S.A. is considering purchasing one of two mining machines for the upcoming year. The more expensive

Question:

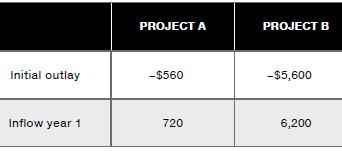

ArcelorMittal S.A. is considering purchasing one of two mining machines for the upcoming year.

The more expensive of the two is better and will produce a higher yield. Assume these investment projects are mutually exclusive and that the required rate of return is 9 percent. Given the following free cash flows:

a. Calculate the NPV of each project.

b. Calculate the PI of each project.

c. Calculate the IRR of each project.

d. If there is no capital-rationing constraint, which project should be selected? If there is a capital-rationing constraint, how should the decision be made?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Foundations Of Finance

ISBN: 9781292318738

10th Global Edition

Authors: Arthur Keown, John Martin, J. Petty

Question Posted: