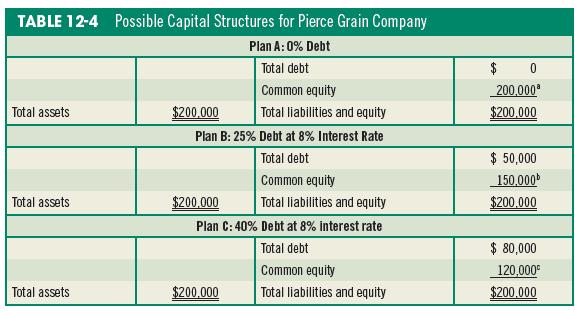

Assume that plan B presented earlier in Table 12-4 is the existing capital structure for the Pierce

Question:

Assume that plan B presented earlier in Table 12-4 is the existing capital structure for the Pierce Grain Company. Furthermore, the asset structure of the firm is such that EBIT is expected to be $20,000 per year for a very long time. A capital investment is available to Pierce Grain that will cost $50,000. Acquisition of this asset is expected to raise the projected EBIT level to $30,000 permanently. The firm can raise the needed cash by one of two ways:

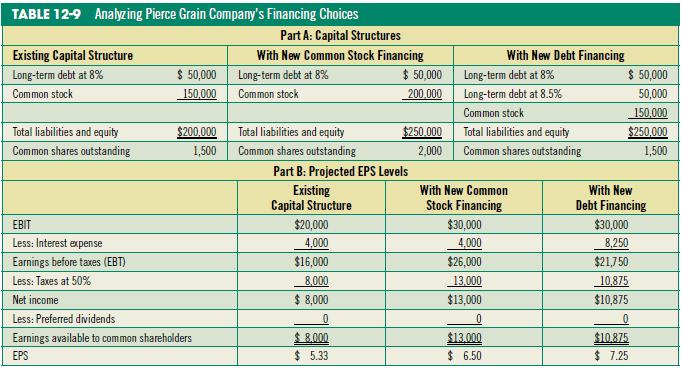

1. Selling 500 shares of common stock at $100 each.

2. Selling new bonds that will net the firm $50,000 and carry an interest rate of 8.5 percent.

These capital structures and corresponding EPS amounts are summarized in Table 12-9.

At the projected EBIT level of $30,000, the EPS levels for the common stock and debt alternatives are $6.50 and $7.25, respectively. Both are considerably above the $5.33 that would occur if the new project were rejected and the new capital were not raised. Based on a criterion of selecting the financing plan that will provide the highest EPS, the bond alternative is favored. But what if the basic business risk to which the firm is exposed causes the EBIT to vary over a considerable range? Can we be sure that the bond alternative will always have the higher EPS associated with it?

Step by Step Answer:

Foundations Of Finance

ISBN: 9781292155135

9th Global Edition

Authors: Arthur J. Keown, John D. Martin, J. William Petty