Ramsey Liquors owns and operates a chain of beer and wine shops throughout the Dallas-Fort Worth metroplex.

Question:

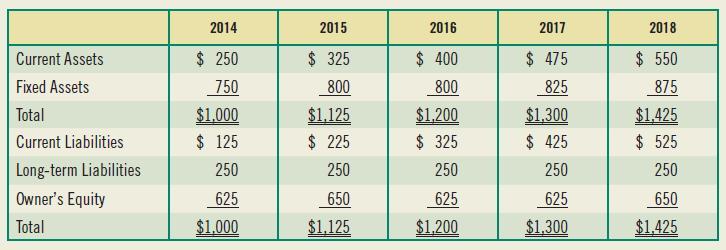

Ramsey Liquors owns and operates a chain of beer and wine shops throughout the Dallas-Fort Worth metroplex. The rapidly expanding population of the area has resulted in the firm requiring a growing amount of funds. Historically, the firm has reinvested earnings and borrowed using short-term bank notes. Balance sheets for the last 5 years are found below.

a. Compute the firm’s current ratio (current assets divided by current liabilities) and the firm’s debt ratio (current plus long-term liabilities divided by total assets) for the 5-year period found above. Describe the firm’s risk using both the current ratio and debt ratio.

b. Alter the financial statements above such that current liabilities remain constant at $50 and long-term liabilities increase in the amount needed to meet the firm’s financing requirements. Compute the firm’s current ratio (current assets divided by current liabilities) and the firm’s debt ratio (current plus long-term liabilities divided by total assets) using the revised financial statements you have prepared for the 5-year period 2014–2018. Describe the firm’s risk using both the current ratio and debt ratio.

c. Which of the financing plans is more risky? Why?

Step by Step Answer:

Foundations Of Finance

ISBN: 9780135160619

10th Edition

Authors: Arthur J. Keown, John H. Martin, J. William Petty