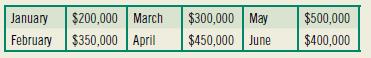

Star Supermarket made the following projections of sales for first six months of 2017: The cost of

Question:

Star Supermarket made the following projections of sales for first six months of 2017:

The cost of goods sold is 60 percent of sales, purchases are all made in credit in previous month of sales. For instance, the inventories for January sales have been purchased in December, and the inventories for February in January. Ten percent of the payment to suppliers was made during the month of purchase, 60 percent in following month, and the remaining 30 percent two months after the purchase. For example, for January purchases, 10 percent will be paid in January, 60 percent in February, and 30 percent in March. Forty percent of sales were in cash, 60 percent on credit. Collections are made in the following two months, in equal parts. Besides these, Star has certain expenses that have to be paid on a monthly basis. Rent of warehouse is $20,000; the interest expense id $10,000; the sale’s commission is $50,000. Star company also expects to pay $25,000 at the end of March and $25,000 at the end of June as tax prepayments. Star Company tries to maintain a security balance, in cash, of $30,000. If this amount is below the figure mentioned, Star Supermarket can borrow at 12 percent annual rate.

Assuming Star will need to repay any accrual interest in June, create the cash budget for January–June, 2017. The cash balance for January 1, 2017, is $45,000; the sales for November is $240,000, and in December the sales was $300,000. The expected sales in July is $350,000.

Step by Step Answer:

Foundations Of Finance

ISBN: 9781292155135

9th Global Edition

Authors: Arthur J. Keown, John D. Martin, J. William Petty