Suppose a firm with a 10 percent required rate of return must replace an aging machine and

Question:

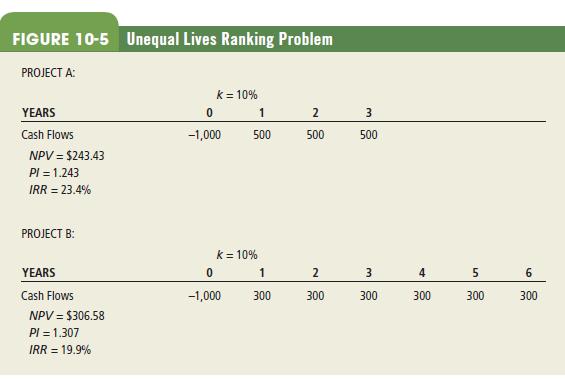

Suppose a firm with a 10 percent required rate of return must replace an aging machine and is considering two replacement machines, one with a 3-year life and one with a 6-year life. The relevant cash flow information for these projects is given in Figure 10-5.

Examining the discounted cash-flow criteria, we find that the net present value and profitability index criteria indicate that project B is the better project, whereas the internal rate of return favors project A. This ranking inconsistency is caused by the different life spans of the projects being compared. In this case, the decision is a difficult one because the projects are not comparable. How do we solve this unequal-lives problem?

Step by Step Answer:

Foundations Of Finance

ISBN: 9781292155135

9th Global Edition

Authors: Arthur J. Keown, John D. Martin, J. William Petty