1. 3M (Minnesota Mining & Manufacturing Co.) was listed in Table 17-1 as one of the companies...

Question:

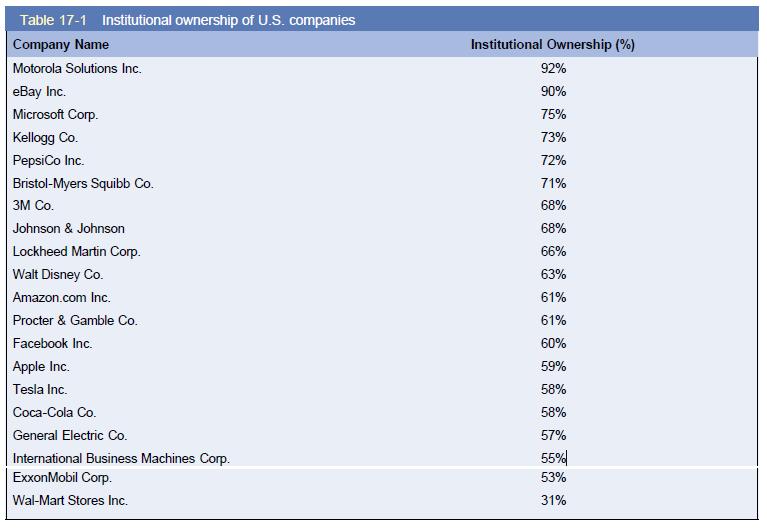

1. 3M (Minnesota Mining & Manufacturing Co.) was listed in Table 17-1 as one of the companies having a large percentage of institutional ownership. Institutional ownership represents stock held by nonindividuals such as pension funds, mutual funds, or bank trust departments. Let’s learn more about the company.

Table 17-1

Go to 3M’s website, www.3m.com, and follow these steps: Select “United States—English.” On the home page click on “About Us” and select “Investor Relations.” Click on “Stock Information” and select “Stock Quote and Chart.”

Go to 3M’s website, www.3m.com, and follow these steps: Select “United States—English.” On the home page click on “About Us” and select “Investor Relations.” Click on “Stock Information” and select “Stock Quote and Chart.”

2. Scroll down and write down the following:

a. Recent price

b. “52-week high”

c. “52-week low”

d. “52-week price percent change”

e. “Volume”

3. Continue scrolling down the page to “Investment Calculator” and click on “Chart $10,000 invested in 3M.” How much would your investment be worth if you reinvested dividends? Compare that to how much you would have if you did not reinvest your dividends.

4. Scroll down further and click on “Data Book.”

a. How has 3M’s stock performed over the time given?

b. What has happened to the P/E ratio and can you give a reason it has changed?

c. How has the dividend grown over time? Would this have an impact on your observation in Question 3?

d. What has happened to the annual earning per share?

e. How has the dividend changed, and how might this be impacted by the growth in earnings per share?

Step by Step Answer:

Foundations Of Financial Management

ISBN: 9781260013917

17th Edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen