Suppose that covered after tax lending and borrowing rates for three units of Eastman Kodak located in

Question:

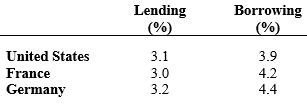

Suppose that covered after tax lending and borrowing rates for three units of Eastman Kodak located in the U.S., France, and Germany are:

a. What is Kodak’s optimal leading and lagging strategy?

b. What is the net profit impact of these adjustments?

c. How would Kodak’s optimal strategy and associated benefits change if the U.S. parent has excess cash available?

Transcribed Image Text:

United States France Germany Lending (%) 3.1 3.0 3.2 Borrowing 3.9 4.2 4.4

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

Currently the French and German units owe 2 million and 3 million respectively to their US parent The German unit also has 1 million in payables outstanding to its French affiliate The timing of these ...View the full answer

Answered By

Tobias sifuna

I am an individual who possesses a unique set of skills and qualities that make me well-suited for content and academic writing. I have a strong writing ability, allowing me to communicate ideas and arguments in a clear, concise, and effective manner. My writing is backed by extensive research skills, enabling me to gather information from credible sources to support my arguments. I also have critical thinking skills, which allow me to analyze information, draw informed conclusions, and present my arguments in a logical and convincing manner. Additionally, I have an eye for detail and the ability to carefully proofread my work, ensuring that it is free of errors and that all sources are properly cited. Time management skills are another key strength that allow me to meet deadlines and prioritize tasks effectively. Communication skills, including the ability to collaborate with others, including editors, peer reviewers, and subject matter experts, are also important qualities that I have. I am also adaptable, capable of writing on a variety of topics and adjusting my writing style and tone to meet the needs of different audiences and projects. Lastly, I am driven by a passion for writing, which continually drives me to improve my skills and produce high-quality work.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Foundations Of Multinational Financial Management

ISBN: 9780470128954

6th Edition

Authors: Alan C Shapiro, Atulya Sarin

Question Posted:

Students also viewed these Business questions

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

Read the case study "Southwest Airlines," found in Part 2 of your textbook. Review the "Guide to Case Analysis" found on pp. CA1 - CA11 of your textbook. (This guide follows the last case in the...

-

1.1. Define a want and a need, and give an example of each. Then, explain how the relationship between wants and needs affects the way people spend money. (4 points) 2.. Identify and describe an...

-

Because of imperfections, an item of merchandise cannot be sold at its normal selling price. How should this item be valued for financial statement purposes?

-

The balance sheet as of December 31, 2011, for Manhein Corporation follows: Required: (a) Compute Manheim Corporation's long-term debt/equity ratio. (b) Assume that Manheim Corporation is considering...

-

Suppose that the intensity of the Poisson process \(N\) is equal to 1 and let \(d L_{t}=L_{t^{-}} \gamma_{t} d M_{t}, L_{0}=1\) where \(\gamma\) is a non-deterministic \(\mathbf{F}^{W}\)-predictable...

-

This information relates to McCall Real Estate Agency. Journalize the transactions. Do not provide explanations. Oct. 1 Stockholders invest $30,000 in exchange for common stock of the corporation. 2...

-

The figure shown on the right illustrates that the numbers 1, 2, 3, 4, 5, and 6 can be placed around a triangle in such away that the three numbers along any side sum to 9, which is shown in the...

-

How does the internal financial transfer system add value to the multinational firm?

-

What is countertrade? Why is it termed a sophisticated form of barter?

-

From what alkyne might each of the following substances have been made? (Yellow-green =Cl) (b) (a)

-

Two months ago, a longstanding customer set up an investment portfolio which is recommended for long term investors. He has asked for the investments to be sold even though there is a significant...

-

Describe how to integrate the visual tool you found it into a stakeholder analysis. Also, show how to create a template of stakeholder analysis for a project including an example of the visual tool...

-

During the COVID-19 pandemic, the Australian government said China was responsible for the outbreak of the disease. The Chinese government was offended, and decide to reduce the quantity of coal...

-

Organizations have both formal and informal (tacit) structures. How can we predict the effects of calculated and deliberate organizational change on informal networks and structures? How can we...

-

1) Juliet is working hard on her students' evaluations.She used to struggle with the writing process, but she came up with a technique that really works for her.She begins to write down whatever...

-

Harold and Maude are both 55 years of age and have two married children. Harold is an engineer and is an active participant in his companys qualified pension plan. Maude is a retired school teacher...

-

What exactly is a prima facie duty? How does an ethic of prima facie duties differ from monistic and absolutist ethical theories?

-

Randy Duck out has been asked to develop an estimate of the per-unit selling price (the price that each unit will be sold for) of a new line of hand-crafted booklets that offer excuses for missed...

-

Develop a statement that expresses the extent to which cost estimating topics also apply to estimating benefits. Provide examples to illustrate.

-

On December 1, AI Smith purchased a car for $18,500. He paid $5000 immediately and agreed to pay three additional payments of $6000 each (which includes principal and interest) at the end of 1, 2,...

-

Alanzo submits an application for a $300,000 whole life insurance policy with the help of his agent and also applies for coverage under a temporary insurance agreement (TIA). His health status is...

-

An employee who uses their own vehicle for employment purposes cannot deduct any financing costs related to the purchase of the car An employee who is provided with a vehicle owned by the employer...

-

Define: Foreign currency. b. The exchange rate. The U.S. interest rate differential.

Study smarter with the SolutionInn App