Galloway Ltd has an authorised capital of 250,000 ordinary shares of 1 each. (a) At the end

Question:

Galloway Ltd has an authorised capital of 250,000 ordinary shares of £1 each.

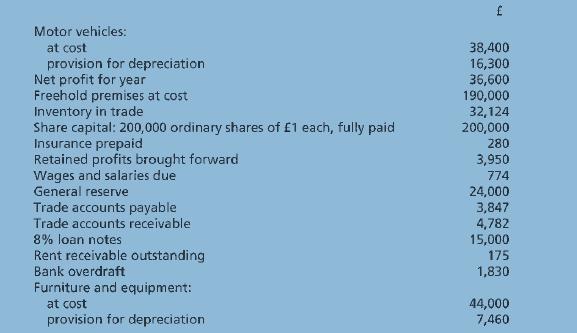

(a) At the end of its financial year, 30 April 2017, the following balances remained in the company's books after preparation of the statement of profit or loss.

The directors have proposed (1) the transfer of £5,000 to the general reserve (2) (2) a final dividend on the ordinary shares of 12.5%.

(b) Galloway Ltd.'s directors are making an assessment of the company's performance for the year. They are concerned by a decline in both profitability and liquidity despite an increase in turnover.

Required:

1 THREE significant differences between ordinary shares and debentures.

2 For Galloway Ltd

(1) a profit and loss appropriation account for the year ending 30 April 2017 (2) a statement of financial position as at 30 April 2017 in a form which shows clearly:

(a) total shareholders' funds

(b) working capital.

3 Concerning the company's performance (1) Name ONE ratio which could be used to assess profitability.

(2) State TWO possible reasons why the profitability ratio may have declined despite increased turnover.

(3) Name ONE ratio, other than working capital ratio, which could be used to assess liquidity.

(4) Give FOUR suggestions as to how working capital could be increased during the year ahead.

Step by Step Answer:

Frank Woods Business Accounting Volume 1

ISBN: 9781292084664

13th Edition

Authors: Alan Sangster, Frank Wood