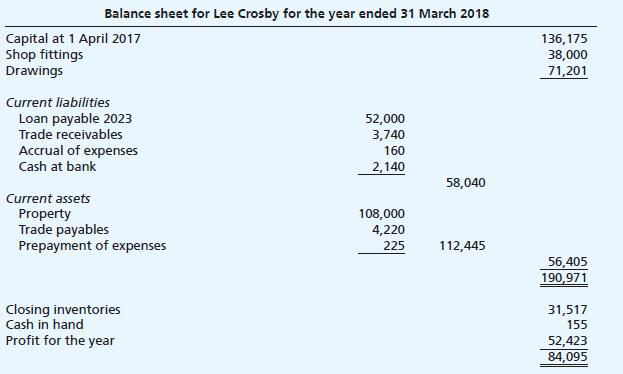

Lee Crosby has just completed his first year of trading selling cookery equipment. He attempted to prepare

Question:

Lee Crosby has just completed his first year of trading selling cookery equipment. He attempted to prepare a balance sheet from his trial balance before seeking expert help as he was having difficulty getting the balance sheet totals to agree. The trial balance included a suspense account balance of

£10,000. This amount has not been entered on the balance sheet.

Additional information at 31 March 2018 1 During the year cookery equipment purchased for resale that had cost £3,500 has been entered in error into the shop fittings account.

2 Lee believes the shop fittings will have an economic life of 5 years and have an estimated residual value of £2,000.

3 The property should be depreciated by 5% using the straight-line method.

4 Lee had withdrawn £75 in cash from the business for his own personal use. This transaction has not yet been accounted for.

5 A credit customer has ceased trading owing Lee £1,040 that will never be received.

6 The wages account has been overstated by £10,000.

7 A credit supplier has issued a credit note of £55 for goods that have been damaged and this has not been entered into the books of account.

Required Prepare a corrected balance sheet at 31 March 2018 taking into account the additional information in points 1–7.

Step by Step Answer:

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood