Manuvra plc is a wholesaler of homeware products. The companys trial balance as at 31 December 2024

Question:

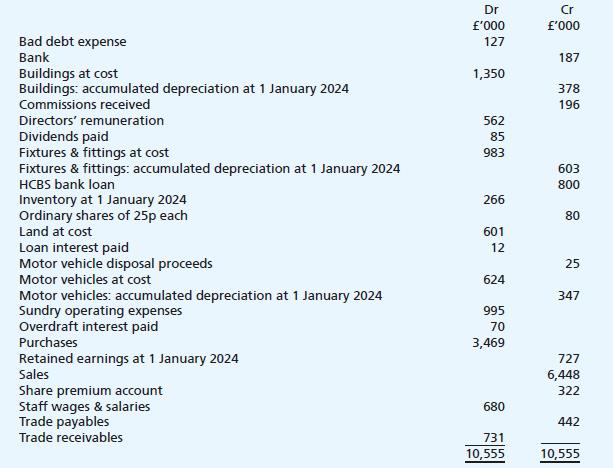

Manuvra plc is a wholesaler of homeware products. The company’s trial balance as at 31 December 2024 is exhibited below:

The following matters also need to be considered before preparing the financial statements:

(i) Inventory at 31 December 2024 was counted and valued at a cost of £283,000.

(ii) The audit fee for 2024 has been agreed at £114,000 and this needs to be accrued.

(iii) The company sold one of its motor vehicles (a sports car) on 1 June 2024 for £25,000. This car had originally been purchased on 1 November 2021 for £48,000. The only entry made for the disposal so far has been to debit bank £25,000 and credit motor vehicle disposal proceeds with £25,000. There were no other purchases or disposals of non-current assets during the year.

(iv) Depreciation is to be charged as follows:

• buildings - 4% straight line • fixtures & fittings - 20% reducing balance • motor vehicles - 25% straight line.

For assets purchased or disposed of part-way through a financial year, the company’s policy is to charge monthly depreciation based on the number of months the asset was owned.

(v) Manuvra Ltd rented extra warehousing space (for the storage of goods prior to their sale) for a period of three months from 1 November 2024 to 31 January 2025. The invoice for the full three months of £123,000 was paid on 9 January 2025. No accounting entries whatsoever have yet been made in relation to this deal.

(vi) A cheque for £28,000 received from a customer (Halgate Ltd) on 23 December (which was recorded in the books of Manuvra Ltd) has been returned by the bank as unpaid. No adjustment has been made in the records for the fact that this cheque has been dishonoured. A liquidator was appointed to Halgate Ltd on 2 January and he has confirmed that the cheque will not be reissued. Management at Manuvra Ltd have decided that the total amount still owed by Halgate Ltd (£43,000) should be written-off as a bad debt.

(vii) The bank reconciliation performed on 31 December 2024 revealed that a cheque for £12,000 was issued to a supplier on 18 December 2024 but this was not recorded at all in the books of Manuvra Ltd.

(viii) The bank loan of £800,000 was borrowed from HCBS on 1 May 2024. The loan is repayable in five equal annual instalments starting on 30 April 2025. Interest is charged on the loan at a fixed rate of 3% per annum. The interest must be paid in two equal annual instalments on 30 April and 31 October each year.

(ix) On 3 December 2024, the land was valued at £1.3m by a professional firm of valuers. The directors of Manuvra plc wish to incorporate this valuation in the year-end financial statements.

(x) The corporation tax due on the profit for the year is estimated to be £66,000 (this estimate is unaffected by the various matters above).

Required:

In a form suitable for publication, prepare the income statement for Manuvra plc for the year ended 31 December 2024 followed by the balance sheet as at that date.

Step by Step Answer:

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood