Sage and Onion are trading in partnership, sharing profits and losses equally. Interest at 5% per annum

Question:

Sage and Onion are trading in partnership, sharing profits and losses equally. Interest at 5% per annum is allowed or charged on both the capital account and the current account balances at the beginning of the year. Interest is charged on drawings at 5% per annum. The partners are entitled to annual salaries of: Sage £12,000; Onion £8,000.

Required:

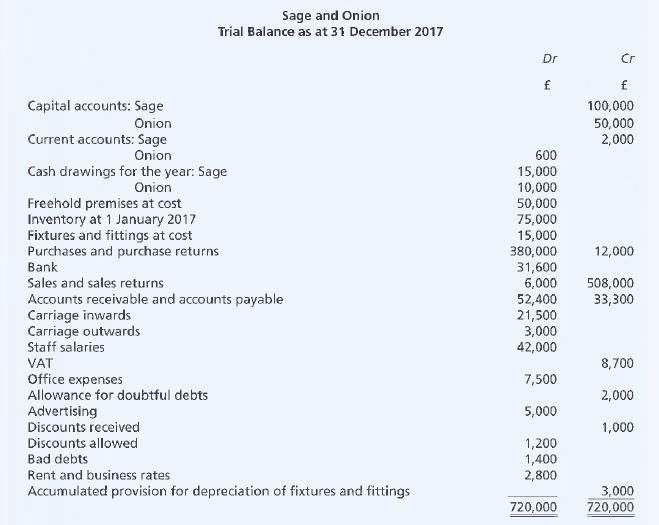

From the information given below, prepare the partnership statement of profit or loss and profit and loss appropriation account for the year ending 31 December 2017, and the statement of financial position as at that date.

At 31 December 2017:

(a) Inventory was valued at £68,000.

(b) Purchase invoices amounting to £3,000 for goods included in the inventory valuation at

(a) above had not been recorded.

(c) Staff salaries owing £900.

(d) Business rates paid in advance £200.

(e) Allowance for doubtful debts to be increased to £2,400.

(f) Goods withdrawn by partners for private use had not been recorded and were valued at: Sage £500, Onion £630. No interest is to be charged on these amounts.

(g) Provision is to be made for depreciation of fixtures and fittings at 10% on cost.

(h) Interest on drawings for the year is to be charged; Sage £360, Onion £280.

Step by Step Answer:

Frank Woods Business Accounting Volume 1

ISBN: 9781292084664

13th Edition

Authors: Alan Sangster, Frank Wood