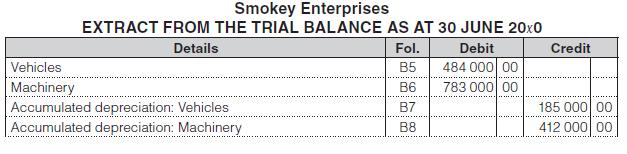

1. Vehicles are depreciated at 20% per annum on the straight-line basis. 2. The business considers the...

Question:

1. Vehicles are depreciated at 20% per annum on the straight-line basis.

2. The business considers the residual value on the vehicles to be 35% on cost.

3. Depreciation on machinery is calculated at 20% per annum on the diminishing-balance method.

4. No depreciation has been recorded for the current year.

5. All amounts are VAT inclusive, unless otherwise stated.

Transactions for the year ended 30 June 20x1:

A New vehicle: 1 September 20x0

– Purchased a new car from Mart Vehicles for an amount of R159 600. A 10% deposit was paid, with the balance being financed through Sure Bank.

– As per the agreement with the bank, the loan bears interest at 12%, with capital payments towards the loan payable half-yearly starting on 1 March 20x1.

– Capital payments due as per the agreement is R20 000 per period.

– A cost of R855 was paid towards the licensing of the car.

– The car was available for use on the same day.

B New vehicle: 1 February 20x1

– Purchased a new vehicle from Maximum Cars, a business not registered for VAT.

The car cost R114 000, and was settled in cash. The car was available for use on the same day.

C New machine: 1 April 20x1

– Purchased a new machine from Hex Machines for R228 000 and paid a 10% deposit.

The balance is to be paid in monthly instalments of R10 000 starting on 30 April 20x1.

– The machine was delivered to Modify This (a VAT registered business), where the machine was modified to suit the business at a total cost of R57 000 (settled in cash). Included in this amount was a payment towards labour of R13 680.

– The machine was returned and available for use on 30 April 20x1.

You may assume the following:

• All interest has been paid.

• All entities listed above are registered VAT vendors unless otherwise stated.

• Interest has been fully paid at year end.

• Fuel expenses for the year were R5 700 and was fully paid at year end.

You are required to

1. Record the transactions and depreciation in the general journal as at 30 June 20x1.

2. Where no VAT has been taken into account, explain briefly the reason for doing so.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit