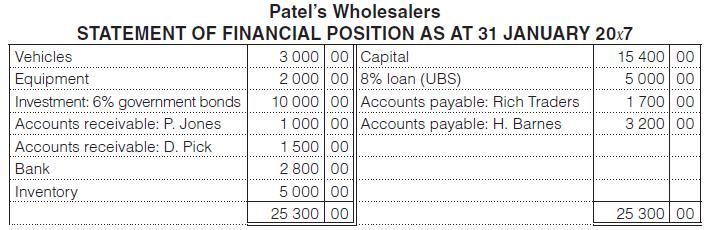

Ebrahim Patel is a wholesaler who uses the periodic inventory system to account for inventory. Transactions for

Question:

Ebrahim Patel is a wholesaler who uses the periodic inventory system to account for inventory.

Transactions for February:

1 Bought inventory from Rich Traders for R5 000 on credit.

2 Sold inventory to D. Pick for R1 000 on credit.

Bought land and buildings for R30 000 paying R2 000 in cash and raising a mortgage bond for the balance.

Bought inventory from Frank’s Retailers, R3 000.

Sold inventory for R8 000 to XYZ Traders and received a cheque for the full amount.

Paid wages, R1 500.

3 Sold inventory to P. Jones for R1 800.

D. Pick returned inventory that was bought on 2 February worth R20.

Purchased inventory for R1 000 cash and paid R40 for railage.

5 P. Jones returned defective inventory worth R10 and Patel’s Wholesalers reimbursed him for the amount.

Bought stationery for R80 from The Bookworm Stationers and paid for it by cheque.

9 Paid H. Barnes the amount due to him.

10 Sold inventory to M & Z Traders for R5 210 and received a cheque for the amount.

11 Received a cheque from D. Pick for the full amount outstanding.

15 Bought inventory from Rich Traders R1 800 on credit.

18 Returned defective inventory worth R80 to Rich Traders.

21 Paid electricity and water account, R150.

24 Paid Rich Traders R2 000 on account.

27 Cash sales of inventory, R4 000.

28 Received interest on government inventory for February.

Paid interest on loan from United Building Society for February.

Mr Patel took R30 worth of inventory for his personal use.

Mr Patel had inventory on hand of R7 500 at the end of February.

You are required to:

1. Record the above transactions in the general journal and post to the general ledger.

2. Close off all nominal accounts and prepare the trading and profit and loss account.

3. Draft the statement of profit or loss & other comprehensive income and statement of financial position.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit