Fancy Free Social Club was established with the main aim of promoting jogging, cycling and indoor exercise.

Question:

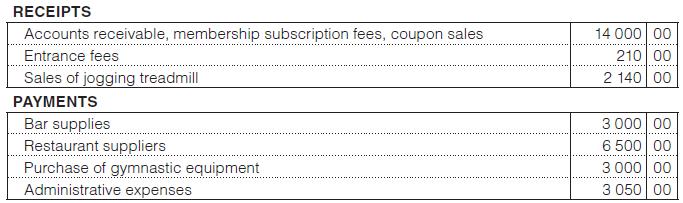

Fancy Free Social Club was established with the main aim of promoting jogging, cycling and indoor exercise. Their cash flow for the year ended 31 May 20x2 is summarised below:

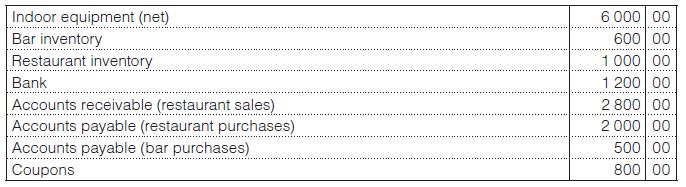

Their assets and liabilities on 1 June 20x1 were:

On further investigation, the following is established:

1. Payment by cash or cheque is not permitted in either the bar or the restaurant.

– Bar sales are strictly in exchange for coupons.

– Restaurant sales are charged to the members’ accounts.

2. No cash purchases are made. Discounts of R500 had been deducted from payments made to restaurant suppliers during the year.

3. An uninsured loss on bar inventory stolen during the year amounted to R700.

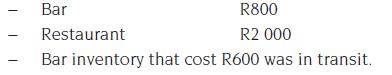

4. Inventory on hand as counted on 31 May 20x2 was as follows:

5. Coupons are sold in books of R20 each at a discount of 10% and are valid only in the financial year in which they are sold and in the year immediately following.

– The club maintains a 20% mark-up on selling price on all bar sales.

– On 31 May 20x2, coupons totalling R1 400 (including R1 200 for coupons issued during the current financial year) were in the hands of members.

6. The jogging treadmill was sold on 31 November 20x1 for an amount that was R340 in excess of its book value at 31 May 20x1.

– The gymnastic equipment was purchased on 1 December 20x1.

– All equipment is depreciated at a rate of 20% per annum using the diminishing balance method.

7. The club had 146 members at 1 June 20x1.

– The annual subscription is R10 per member, and each new member pays an additional entrance fee of R15.

– All membership subscription fees had been received by 31 May 20x2 and three members had also paid their membership subscription fees up to 31 May 20x3.

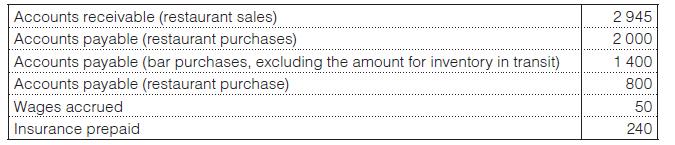

8. These balances are known at 31 May 20x2:

You are required to:

1. Prepare a trading statement for the year ended 31 May 20x2.

2. Prepare a statement of income and expenditure for the year ended 31 May 20x2.

3. Prepare a post-closing trial balance as at 31 May 20x2.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit