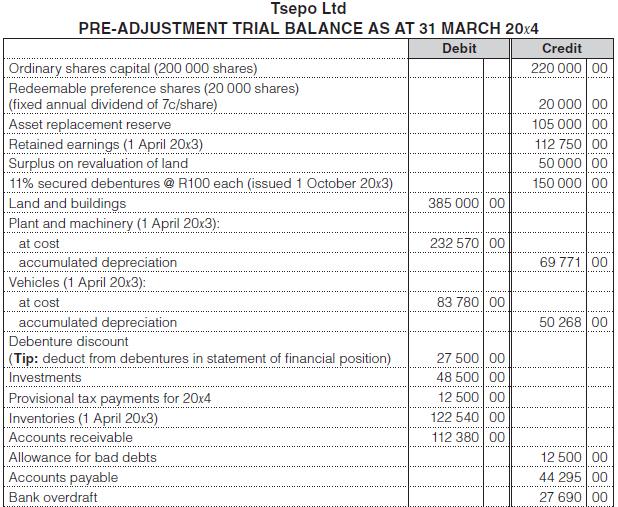

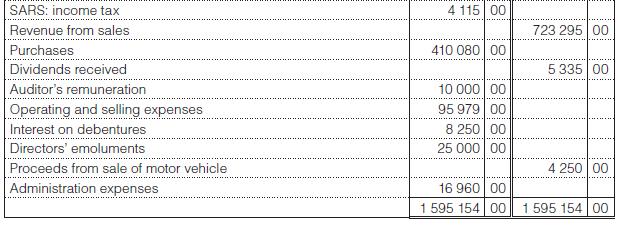

Here is the pre-adjustment trial balance of Tsepo Ltd as at 31 March 20x4: This additional information

Question:

Here is the pre-adjustment trial balance of Tsepo Ltd as at 31 March 20x4:

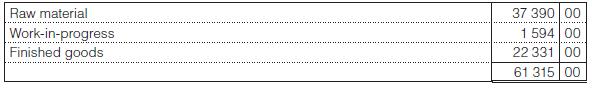

This additional information relates to the trial balance:

1. The plant and machinery were bought on 1 April 20x0.

– A machine that cost R13 580 has been debited to selling and operating expenses.

– The machine was bought on 1 October 20x3.

– Depreciation is written off at 10% per annum on a straight-line basis.

2. The vehicles were bought on 1 April 20x0.

– A vehicle that cost R17 780 was disposed of on 1 October 20x3.

– No purchases took place during the year.

– Depreciation is written off at 20% per annum on a straight-line basis.

3. Inventories on 31 March 20x4 consist of:

4. Allowance for bad debts is to be maintained at 10% of accounts receivable.

5. Income tax:![]()

A provision of R39 349 is to be made for the current year.

6. During the year the company had R150 000 on deposit with a bank. Interest received of R6 690 has been credited to sales.

7. A dividend of 5c/share is to be provided for. (Ignore any dividend tax implications.)

You are required to:

1. Journalise the entries to correct the financial statements. (Narrations are not required.)

2. Prepare the statement of profit or loss & other comprehensive income of Tsepo Ltd for the year ended 31 March 20x4.

3. Prepare the statement of financial position as at 31 March 20x4.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit