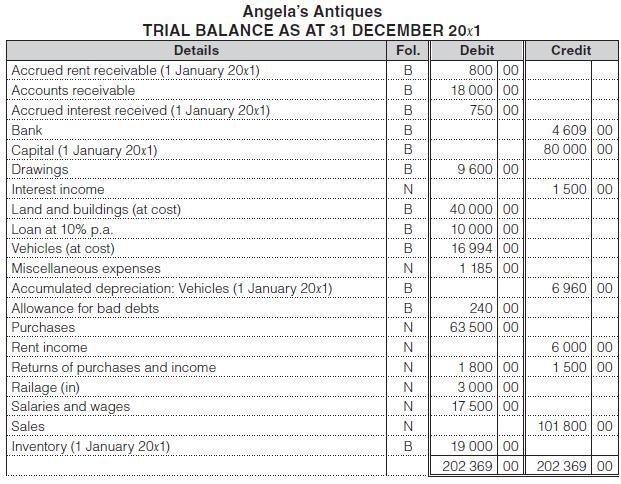

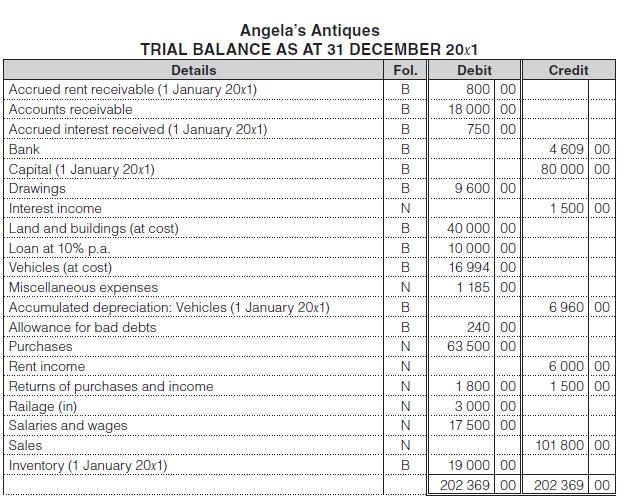

Here is the trial balance of Angelas Antiques, a furniture dealer. Angela Boshoff determines inventory values on

Question:

Here is the trial balance of Angela’s Antiques, a furniture dealer. Angela Boshoff determines inventory values on a LIFO basis using the periodic method. Her marketing policy has been to consistently earn a gross profit of 40% of selling prices.

Additional information:

1. Most of Boshoff’s inventory on hand was destroyed in a fire that happened after the close of business on 31 December 20x1.

– A physical inventory count of the salvaged items was valued at R6 000.

– The inventory was insured for R20 000 by a standard fire policy that contained an ‘average’ clause.

2. Boshoff leases a portion of her building to a tenant for a monthly rent of R400.

3. On 1 January 20x0, the business loaned R15 000 to its main supplier for a five-year period at an interest rate of 10% per annum.

– Interest is payable half-yearly in arrears on 1 January and 1 July.

– On 1 July 20x1, the supplier sent a cheque for the half-year’s interest.

– On 30 September 20x1, he sent another cheque for R5 000 in part repayment of the loan.

– Both transactions were correctly recorded on the dates mentioned.

4. On 1 April 20x1, one of the business’s delivery vans was traded in as part payment for a new vehicle that cost R6 000.

– The van that was traded in, had been bought two years and three months ago, for R4 000 and its trade-in value was R1 006.

– The balance of the purchase price of the new vehicle was paid by cheque.

– The only entry recorded for the entire transaction has been the debit to vehicles and the credit to bank for R4 994 (the amount of the cheque).

5. Vehicles are depreciated at 40% per annum using the diminishing-balance method.

6. Miscellaneous expenses includes R324 for property rates for the period 1 January 20x2 to 30 June 20x2.

7. On 1 January 20x1, the allowance for bad debts account had an opening balance of R1 000.

– The account had been debited with a total of R1 240 during the year, with credit entries to receivables.

– It is the business’s policy to make an allowance for a proportion of accounts receivable which, at the end of each financial year, is estimated as being uncollectable.

– This estimate is calculated at 5% of year-end accounts receivable balance.

You are required to:

1. Prepare general journal entries for adjustments where appropriate.

2. Prepare the statement of profit or loss & other comprehensive income for the year ended 31 December 20x1.

3. Prepare the statement of financial position as at 31 December 20x1.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit