The following accounting events apply to Ginger's Designs for the year 2011. Asset Source Transactions 1. Began

Question:

The following accounting events apply to Ginger's Designs for the year 2011.

Asset Source Transactions

1. Began operations by acquiring \(\$ 40,000\) of cash from the issue of common stock.

2. Performed services and collected cash of \(\$ 2,000\).

3. Collected \(\$ 12,000\) of cash in advance for services to be provided over the next 12 months.

4. Provided \(\$ 24,000\) of services on account.

5. Purchased supplies of \(\$ 3,000\) on account.

Asset Exchange Transactions

6. Purchased \(\$ 8,000\) of land for cash.

7. Collected \(\$ 14,000\) of cash from accounts receivable.

8. Purchased \(\$ 1,260\) of supplies with cash.

9. Paid \(\$ 4,800\) for one year's rent in advance.

Asset Use Transactions

10. Paid \(\$ 8,000\) cash for salaries of employees.

11. Paid a cash dividend of \(\$ 4,000\) to the stockholders.

12. Paid off \(\$ 1,260\) of the accounts payable with cash.

Claims Exchange Transactions

13. Placed an advertisement in the local newspaper for \(\$ 1,600\) on account.

14. Incurred utility expense of \(\$ 1,200\) on account.

Adjusting Entries

15. Recognized \(\$ 8,800\) of revenue for performing services. The collection of cash for these services occurred in a prior transaction. (See Event 3.)

16. Recorded \(\$ 3,000\) of accrued salary expense at the end of 2011.

17. Recorded supplies expense. Had \(\$ 1,200\) of supplies on hand at the end of the accounting period.

18. Recognized four months' of expense for prepaid rent that had been used up during the accounting period.

19. Recognized \(\$ 300\) of accrued interest revenue.

Required

a. Record each of the preceding events in T-accounts.

b. Prepare a before-closing trial balance.

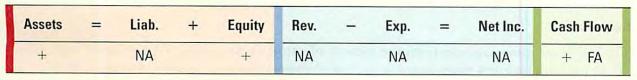

c. Use a horizontal statements model to show how each event affects the balance sheet, income statement, and statement of cash flows. Indicate whether the event increases \((+)\), decreases ( -\()\), or does not affect (NA) each element of the financial statements. Also, in the Cash Flow column, use the letters OA to designate operating activity, IA for investing activity, and FA for financing activity. The first event is recorded as an example.

Step by Step Answer: