After the success of its first two months, Mary Graham has decided to continue operating Echo Systems.

Question:

After the success of its first two months, Mary Graham has decided to continue operating Echo Systems. (The transactions that occurred in these months are described in Chapter 2.) Before proceeding in December, Graham adds these new accounts to the chart of accounts for the ledger:

Account No.Accumulated Depreciation, Office Equipment ................................. 164Accumulated Depreciation, Computer Equipment ......................... 168Wages Payable ..................................................................................... 210Unearned Computer Services Revenue ............................................ 236Depreciation Expense, Office Equipment......................................... 612Depreciation Expense, Computer Equipment ................................. 613Insurance Expense .............................................................................. 637Rent Expense ....................................................................................... 640Computer Supplies Expense .............................................................. 652

Required

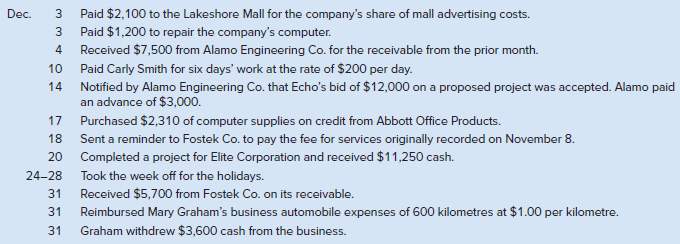

1. Prepare journal entries to record each of the following transactions for Echo Systems. Post the entries to the accounts in the ledger.

2. Prepare adjusting entries to record the following additional information collected on December 31, 2020. Post the entries to the accounts in the ledger.

a. The December 31 inventory of computer supplies was $1,440.

b. Three months have passed since the annual insurance premium was paid.

c. As of the end of the year, Carly Smith has not been paid for four days of work at the rate of $200 per day.

d. The computer is expected to have a four-year life with no residual value.

e. The office equipment is expected to have a three-year life with no residual value.

f. Prepaid rent for three of the four months has expired.

3. Prepare an adjusted trial balance as of December 31, 2020.

4. Prepare an income statement and statement of changes in equity for the three months ended December 31, 2020.

5. Prepare a balance sheet as of December 31, 2020.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Fundamental Accounting Principles Volume I

ISBN: 978-1260305821

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann