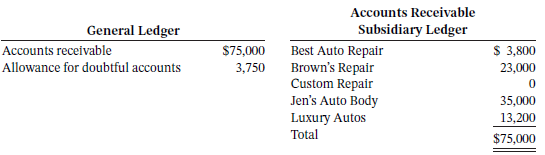

At December 31, 2021, the general ledger and subsidiary ledger for Albert?s, a small auto parts store,

Question:

At December 31, 2021, the general ledger and subsidiary ledger for Albert?s, a small auto parts store, showed the following:

Jan. 3 Brown?s Repair paid $18,000 on its account.

4 Custom Repair paid $1,400 on its account that had previously been written off .

8 Jen?s Auto Body purchased $3,800 of merchandise on account.

9 Antique Auto Repair paid cash for $1,500 of merchandise.

18 Jen?s Auto Body returned $800 of merchandise

19 Luxury Autos paid $13,200 on its account.

20 Jen?s Auto Body paid $25,000 on its account.

23 Brown?s Repair purchased $5,600 on account.

25 Custom Repair purchased $10,000 of merchandise on Visa.

26 Luxury Autos purchased $18,000 of merchandise on account.

31 Albert?s determined that the Best Auto Repair account receivable was not collectible.

Record the above transactions. Ignore credit card fees and any entries to merchandise inventory and cost of goods sold, for the purposes of this question.

b. Set up T accounts for the Accounts Receivable general ledger (control) account, the Allowance for Doubtful Accounts general ledger account, and the Accounts Receivable subsidiary ledger accounts. Post the journal entries to these accounts.

c. Albert?s estimated that 10% of accounts receivable is not collectible. Record the required adjustment to the Allowance for Doubtful Accounts.

d. Prepare a list of customers and the balances of their accounts from the subsidiary ledger. Prove that the total of the subsidiary ledger is equal to the control account balance.

Albert Erickson, the owner of Albert?s, is considering changing his customer payment policy. He wants to discontinue offering credit to his customers and accept only bank credit and debit cards as well as cash. Provide Albert with a list of advantages and disadvantages for the proposed policy change.

Step by Step Answer:

Accounting Principles Volume 1

ISBN: 978-1119502425

8th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak