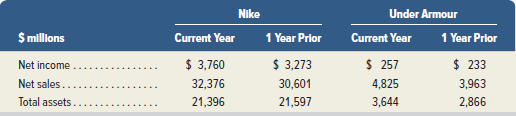

Following are financial data for Nike and Under Armour. (1) Compute return on total assets for the

Question:

Following are financial data for Nike and Under Armour.

(1) Compute return on total assets for the current year for

(a) Nike

(b) Under Armour.

(2) Compute both profit margin and total asset turnover for the current year for

(a) Nikeand

(b) Under Armour.

(3) Which company more efficiently used its assets in the current year?

Asset turnover is sales divided by total assets. Important for comparison over time and to other companies of the same industry. This is a standard business ratio.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: