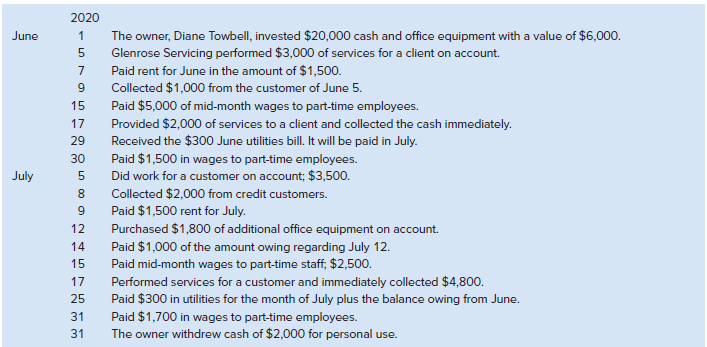

Glenrose Servicing began operations on June 1, 2020. The transactions for the first two months follow: Required

Question:

Glenrose Servicing began operations on June 1, 2020. The transactions for the first two months follow:

Required

1. Create two tables like the one in Exhibit 1.15 for each of June and July using the following headings for the columns: Cash; Accounts Receivable; Office Equipment; Accounts Payable; Diane Towbell, Capital; and Explanation of Equity Transaction.

2. Use additions and subtractions to show the effects of the above transactions on the elements of the equation for each of June and July.

3. Prepare an income statement and statement of changes in equity for each of the months ended June 30 and July 31, 2020. Also prepare a balance sheet at June 30, 2020, and July 31, 2020.

Analysis Component: Answer each of the following questions:

1. Assets increased by $800 from June 30, 2020 to July 31, 2020. How was this increase financed?

2. Which financial statement reports on a company?s

a. performance?

b. financial position?

Explain what is meant by each of these terms.

3. Explain how Glenrose Servicing?s July income statement, statement of changes in equity, and balance sheet are linked.

Balance SheetBalance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Fundamental Accounting Principles Volume I

ISBN: 978-1260305821

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann