Natalie is struggling to keep up with the recording of her accounting transactions. She is spending a

Question:

Natalie is struggling to keep up with the recording of her accounting transactions. She is spending a lot of time marketing and selling smoothies and juicers. Her friend John is an accounting student who runs his own accounting service. He has asked Natalie if she would like to have him do her accounting.

John and Natalie meet and discuss her business. John suggests that he could perform the following procedures for Natalie:

1. Take the deposits to the bank every Friday. All cheques and cash received would be kept in a locked box at Natalie?s house.

2. Write and sign all of the cheques. He would review the invoices and send out cheques as soon as the invoices are received.

3. Record all of the deposits in the accounting records.

4. Record all of the cheques in the accounting records.

5. Prepare the monthly bank reconciliation.

6. Transfer Natalie?s manual accounting records to his computer accounting program. John maintains the accounting information that he keeps for his clients on his laptop computer.

7. Prepare monthly financial statements for Natalie to review.

8. Write himself a cheque every month for the work he has done for Natalie.

Instructions

a. Identify the weaknesses in internal control that you see in the system John is recommending. Can you suggest any improvements if Natalie hires John to do the accounting?

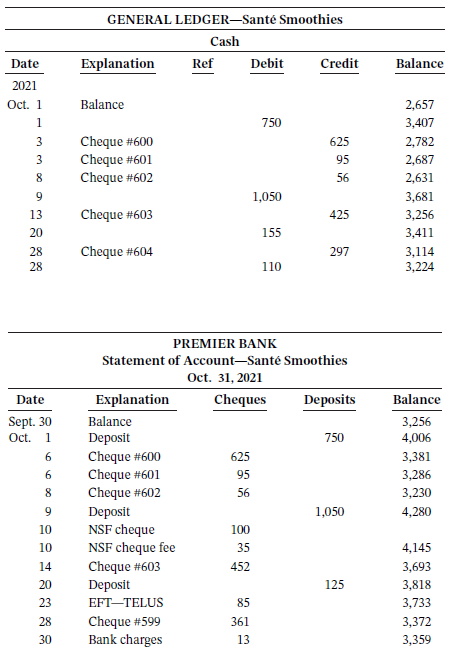

b. Natalie would like you to help her. She asks you to prepare a bank reconciliation for October 31, 2021, and any necessary journal entries using the following information.

Additional information:

1. On September 30, there were two outstanding cheques: #595 for $238 and #599 for $361.

2. Premier Bank made a posting error to the bank statement: cheque #603 was issued for $425, not $452.

3. The deposit made on October 20 was for $125 that Natalie received for selling smoothies. Natalie made an error in recording this transaction.

4. Natalie decided to set up an automatic payment to Telus for her cell phone invoice every month. Remember that she uses this phone only for business.

5. The NSF cheque was from Ron Black. Natalie received this cheque for selling smoothies to Ron and his children. Natalie contacted Ron, and he assured her that she will receive a cheque in the mail for the outstanding amount of the invoice and the NSF bank charge.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Accounting Principles Volume 1

ISBN: 978-1119502425

8th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak