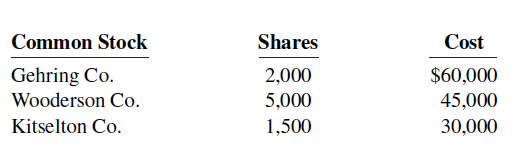

On December 31, 2020, Turnball Associates owned the following securities, held as a long-term investment. The securities

Question:

On December 31, 2020, the total fair value of the securities was equal to its cost. In 2021, the following transactions occurred.

Aug. 1 Received $0.50 per share cash dividend on Gehring Co. common stock.

Sept. 1 Sold 1,500 shares of Wooderson Co. common stock for cash at $8 per share.

Oct. 1 Sold 800 shares of Gehring Co. common stock for cash at $33 per share.

Nov. 1 Received $1 per share cash dividend on Kitselton Co. common stock.

Dec. 15 Received $0.50 per share cash dividend on Gehring Co. common stock.

31 Received $1 per share annual cash dividend on Wooderson Co. common stock.

At December 31, the fair values per share of the common stocks were: Gehring Co. $32, Wooderson Co. $8, and Kitselton Co. $18.

Instructions

a. Journalize the 2021 transactions and post to the account Stock Investments. (Use the T-account form.)

b. Prepare the adjusting entry at December 31, 2021, to show the securities at fair value.

c. Show the balance sheet presentation of the investments at December 31, 2021. At this date, Turnball Associates has common stock $1,500,000 and retained earnings $1,000,000.

Stocks or shares are generally equity instruments that provide the largest source of raising funds in any public or private listed company's. The instruments are issued on a stock exchange from where a large number of general public who are willing... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Accounting Principles

ISBN: 978-1119411482

13th edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso