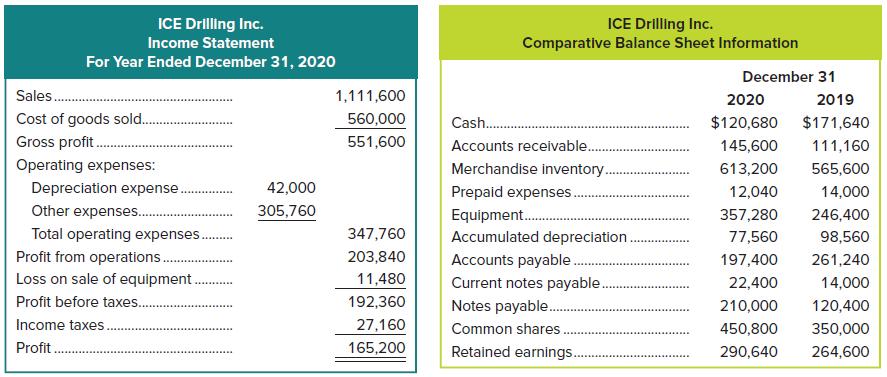

Refer to the information in Problem 16-5A. Prepare a statement of cash flows for 2020 using the

Question:

Refer to the information in Problem 16-5A. Prepare a statement of cash flows for 2020 using the direct method to report cash inflows and outflows from operating activities.

Other information:

a. All sales are credit sales.

b. All credits to accounts receivable in the period are receipts from customers.

c. Purchases of merchandise are on credit.

d. All debits to accounts payable in the period result from payments for merchandise.

e. The only decrease in income taxes payable is for payment of taxes.

f. The other expenses are paid in advance and are initially debited to Prepaid Expenses.

Problem 16-5A

Accounts payable (AP) are bills to be paid as part of the normal course of business.This is a standard accounting term, one of the most common liabilities, which normally appears in the balance sheet listing of liabilities. Businesses receive... Accounts Receivable

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamental Accounting Principles Volume II

ISBN: 978-1260305838

16th Canadian edition

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann

Question Posted: