The Koebels have considered the offer extended by Coffee Beans Ltd. (see Chapter 17) and have turned

Question:

The Koebels have considered the offer extended by Coffee Beans Ltd. (see Chapter 17) and have turned it down. Instead, Brian, Janet, and Natalie have decided to continue operating Sant? Smoothies & Sweets Ltd. and to expand the business.

Sant? Smoothies & Sweets Ltd. once again has excess cash for its expansion but needs time to organize it. In the meantime, the cash could be invested. The Koebels have been approached by a family friend who works in the investment industry. This family friend has made a strong recommendation to buy shares in Okanagan Fruit & Vegetable Corp., a public company. Because Janet, Brian, and Natalie produce and sell fresh fruit and vegetable smoothies, they believe that investing in a public company that produces and distributes fruits and vegetables could be a good investment. The investment in Okanagan Fruit & Vegetable Corp. could provide a significant return on a short-term basis while the Koebels organize for the expansion.

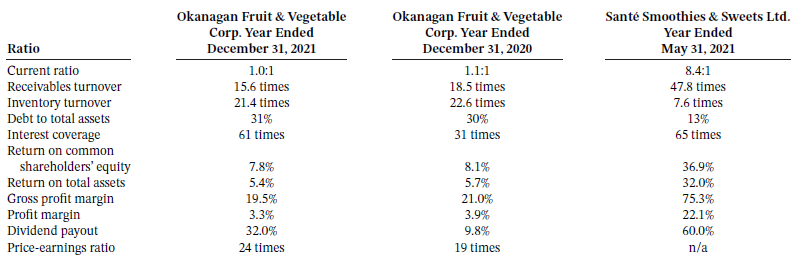

In order to assess this investment, Natalie has calculated several ratios for both Okanagan Fruit & Vegetable Corp. and Sant? Smoothies & Sweets Ltd. as follows:

Instructions

a. Which company is more liquid? Explain.

b. Which company is more solvent? Explain.

c. Which company is more profitable? Explain.

d. Are Okanagan?s ratios improving? Explain.

e. Overall, why do you think that ratios of Sant? are stronger than those of Okanagan Fruit & Vegetable Corp.?

f. What other considerations must the Koebels keep in mind before making an investment in any public company?

Step by Step Answer:

Accounting Principles Volume 2

ISBN: 978-1119502555

8th Canadian Edition

Authors: Jerry J. Weygandt, Donald E. Kieso, Paul D. Kimmel, Barbara Trenholm, Valerie Warren, Lori Novak